Somatostatin Analogs Size

Somatostatin Analogs Market Growth Projections and Opportunities

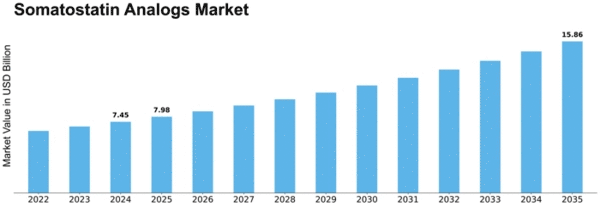

The Somatostatin Analogs Market will reach USD 12.05 billion by 2032 at a CAGR of 7.1% during the forecast period. The market for somatostatin analogs is dynamic and influenced by several factors that collectively shape its growth prospects for the coming years. These chemical compounds that imitate the effects of naturally occurring somatostatin hormones are vital in treating many endocrinology conditions. The dynamics of the Somatostatin Analogs Market significantly depend on research and development (R&D) activities within this industry. Pharmaceutical manufacturers, as well as researchers, are continually innovating better analog formulations that would improve efficacy, patient compliance, and duration of effect while enhancing these properties. Ongoing clinical trials, advancements in drug delivery systems, and expanding indications contribute to widening treatment options, thereby positively influencing market dynamics in this case. The exploration for new and more efficient somatostatin analogs also drives industry movements. Technological advancements play a substantial role in determining the market dynamics for these types of drugs by making them much easier to deliver into bodies over long distances or short ones through different routes, such as subcutaneous injections, among others, thus improving patient compliance and comfort. Besides enhancing treatment choices, these medical innovations have helped create an environment where doctors can effectively manage various health problems mainly because they empower clinicians with modern tools and technologies used in managing illnesses more accurately. Regulation matters, including approval processes, are key considerations that influence market dynamics on somatostatin analogs. Strict regulatory standards ensure the safety and effectiveness of new drugs, while regulatory approvals give credibility to treatments and facilitate access to markets for such products. Pharmaceutical companies use strategies like improved versions of existing drugs or entirely new ones depending on their target market segment. Such companies need a thorough understanding of their product's intended usage and prevailing government regulations since it allows them to strategically navigate through those landscapes so as to bring onto markets new, improved somatostatin analogs, all of which have broader implications industrywide. Market dynamics are also influenced by competition among pharmaceutical companies and healthcare stakeholders. The companies employ various strategies such as mergers, acquisitions, and collaborations to strengthen their market positions and expand their somatostatin analog portfolios. Economic factors are also critical in the market dynamics of somatostatin analogs. Economic conditions affect the patterns of health care spending that affect how affordable and accessible patients can access treatment for various treatments. Economic downturns may lead to cost-conscious approaches in healthcare, potentially impacting market growth. Consumer demand patterns greatly influence market dynamics. Consumers' rising awareness of endocrine disorders and increased availability of somatostatin analogs encourage patients to seek timely treatment options with efficiency. Factors such as decreased side effects, less frequent dosing regimens preferred by customers or patients, and ease of use are guiding the development efforts toward the production of innovative drug formulations and therapeutic modalities.

Leave a Comment