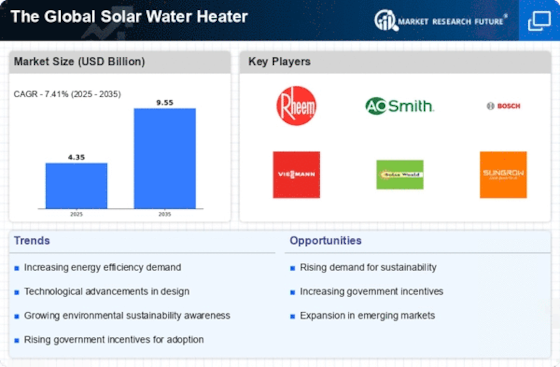

Rising Energy Costs

The increasing cost of conventional energy sources is a pivotal driver for The Global Solar Water Heater Industry. As energy prices continue to rise, consumers and businesses are seeking alternative solutions to mitigate their energy expenses. Solar water heaters present a cost-effective option, allowing users to harness solar energy for heating water, thereby reducing reliance on expensive fossil fuels. In many regions, the cost of solar water heating systems has decreased significantly, making them more accessible. According to recent data, the average payback period for solar water heaters has improved, often falling within 3 to 7 years, depending on local energy prices and incentives. This economic advantage is likely to propel the adoption of solar water heaters, as more consumers recognize the long-term savings associated with these systems.

Environmental Concerns

Growing environmental awareness is a crucial factor influencing The Global Solar Water Heater Industry. As climate change and environmental degradation become increasingly pressing issues, consumers and governments alike are prioritizing sustainable energy solutions. Solar water heaters, which utilize renewable energy, contribute to reducing greenhouse gas emissions and reliance on non-renewable resources. The shift towards eco-friendly technologies is evident, with many countries implementing policies to promote renewable energy adoption. For instance, various nations have set ambitious targets for reducing carbon footprints, which often include incentives for solar energy systems. This trend suggests that as environmental concerns continue to rise, the demand for solar water heaters will likely increase, positioning them as a viable solution for both residential and commercial applications.

Increasing Urbanization

The trend of increasing urbanization is a significant driver for The Global Solar Water Heater Industry. As urban populations grow, the demand for energy-efficient solutions in residential and commercial buildings intensifies. Urban areas often face challenges related to energy supply and environmental sustainability, making solar water heaters an appealing option. The integration of solar water heating systems in urban infrastructure can help alleviate pressure on conventional energy sources while promoting sustainable living. Moreover, many urban centers are implementing building codes that encourage or require the use of renewable energy technologies, including solar water heaters. This urban shift towards sustainability is expected to create substantial opportunities for market players, as more consumers and developers seek to incorporate solar solutions into their projects.

Technological Innovations

Technological advancements play a significant role in shaping The Global Solar Water Heater Industry. Innovations in solar technology, such as improved photovoltaic cells and enhanced thermal storage systems, have led to more efficient and reliable solar water heaters. These advancements not only increase the efficiency of solar water heating systems but also reduce installation and maintenance costs. For example, the integration of smart technology allows users to monitor and control their systems remotely, optimizing energy use. Furthermore, the development of hybrid systems that combine solar with traditional energy sources offers flexibility and reliability, appealing to a broader consumer base. As technology continues to evolve, it is anticipated that the market will witness a surge in innovative products, further driving the adoption of solar water heaters.

Government Incentives and Policies

Supportive government policies and incentives are instrumental in propelling The Global Solar Water Heater Industry. Many governments worldwide are recognizing the importance of renewable energy in achieving sustainability goals and are implementing various programs to encourage the adoption of solar technologies. These initiatives often include tax credits, rebates, and grants for consumers who invest in solar water heating systems. Additionally, regulatory frameworks that mandate the use of renewable energy in new constructions are becoming more common. Such policies not only lower the initial investment barrier for consumers but also create a favorable market environment for solar water heater manufacturers. As these incentives continue to evolve, they are likely to stimulate market growth and enhance the overall attractiveness of solar water heating solutions.