Market Share

Solar Hydrogen Panel Market Share Analysis

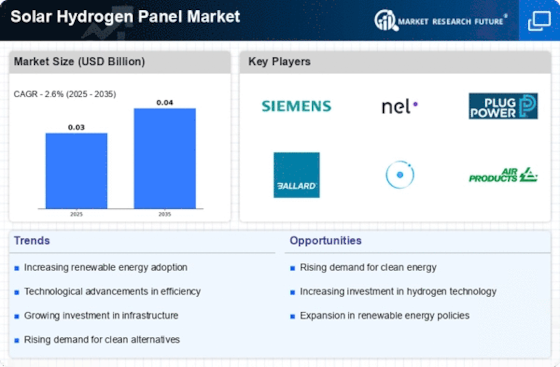

The solar hydrogen panel market has been growing substantially in the last few years, driven by increased global demand for eco-friendly and sustainable energy sources. While countries are making efforts towards reducing carbon emissions, solar hydrogen panels have emerged as a technology of great interest, which utilizes sun’s power to produce clean and versatile carrier of energy, hydrogen.

Among the crucial market trends in the solar hydrogen panel industry is the increasing adoption of this technology across different sectors. Solar hydrogen panels are being used in various applications from residential based purposes to large-scale industrial projects. Growing concerns about climate change and carbon footprints by homeowners are boosting interests regarding solar hydrogen panels in residential areas. On the other hand, companies use them for sustainable running of their operations in line with corporate sustainability objectives.

Government support and favorable policies have been driving forces behind growth of the solar hydrogen panel market. Many states offer incentives like subsidies as well as regulatory assistance that promote uptake of renewable energy technologies including solar hydrogen panels. This encouragement has created conducive environment for investment in research and development leading to improved panel efficiency and cost reductions. The result is that today there is enormous competition on the solar hydrogen panel market which makes it even more attractive to both customers and businesses alike.

Market growth has been mostly due to technological advancements made in design and manufacturing processes within the sphere of solar oxygen cell production. Solar oxygen cells become less expensive thanks to new materials used during their production, betterness of manufacturing techniques or improved system integration with other devices. These developments not only contribute to enhanced efficiency but also prolong lifetime hence strengthening their desirability among clean energy options.

Increasing rates at which enterprises are partnering together implies that partnerships become frequent within this field too since companies acknowledge that they cannot achieve goals alone. Joint efforts make it possible finding solutions for introduction/implementation difficulties arising from incorporating innovative technology into such a competitive segment as an alternative source of energy production- thus pooling resources, sharing information- that is what it takes. Innovation is born through such collaborations, which create a win-win situation for the whole solar hydrogen panel chain.

Leave a Comment