Top Industry Leaders in the Solar Hydrogen Panel Market

*Disclaimer: List of key companies in no particular order

Latest Company Updates:

Harnessing Sunlight and H2O: Exploring the Competitive Landscape of the Solar Hydrogen Panel Market

Beneath the sun's radiant gaze, a nascent battleground emerges, where technology and sustainability converge - the solar hydrogen panel market. This multi-million dollar space hums with potential, with established players, innovative disruptors, and regional champions vying for a share in converting sunlight and water into clean, hydrogen energy. Let's delve into the key strategies, market dynamics, and future trends shaping this dynamic landscape.

Key Player Strategies:

Technology Leaders: Companies like SunHydrogen Inc. and Enapter leverage their deep understanding of electrolysis technology and focus on developing high-efficiency solar hydrogen panels. They cater to energy-intensive industries seeking green hydrogen production solutions, offering customizable systems and robust technical expertise. SunHydrogen's SunBox HyDrop solution showcases their focus on modular and scalable hydrogen generation technology.

Cost-Effective Challengers: Chinese manufacturers like Suzhou GH New Energy Co. Ltd. and Flux50 are making waves with competitively priced solar hydrogen panels, targeting budget-conscious customers in emerging markets. They focus on affordability and basic functionality, offering alternatives to premium brands. Flux50's hydrogen generation systems demonstrate their emphasis on cost-effective solutions.

Regional Champions: Companies like Schmid Group in Germany and Proton OnSite in the United States excel in specific geographic regions, leveraging strong local relationships and deep understanding of regional regulations and subsidies. They offer tailored solutions and expertise for navigating regional challenges. Schmid Group's partnership with Shell in Germany exemplifies their focus on collaborating with major players to accelerate market adoption.

Sustainable Partnerships: Companies like Nel Hydrogen and Sunfire GmbH are actively forming partnerships with renewable energy developers, hydrogen infrastructure providers, and research institutions. They leverage these collaborations to expand their reach, access wider markets, and advance shared sustainability goals. Nel Hydrogen's partnership with Green Hydrogen Systems in Australia showcases their focus on collaborative project development.

Factors for Market Share Analysis:

Technology Innovation: Investing in R&D for next-generation materials, electrolyzer efficiency improvements, and integration with advanced automation and AI-driven control systems is crucial for staying ahead of the curve. Companies leading in innovation attract premium contracts and early adopters.

Cost and Affordability: Balancing advanced features with competitive pricing is vital for mass adoption, particularly in cost-sensitive sectors. Companies offering affordable solutions without compromising efficiency or long-term reliability stand out.

Hydrogen Infrastructure and Integration: Providing solutions that seamlessly integrate with existing hydrogen storage, transportation, and utilization infrastructure is key for customer adoption. Companies facilitating seamless integration gain an edge.

Regulatory Landscape and Incentive Programs: Understanding and navigating the evolving regulatory landscape, including government subsidies and support programs for green hydrogen adoption, is crucial for project feasibility and market penetration. Companies with strong policy expertise gain market share.

New and Emerging Trends:

Focus on Decentralized Hydrogen Production: Developing modular and scalable solar hydrogen panel systems enables localized hydrogen production for off-grid applications, microgrids, and remote communities. Companies offering decentralized solutions cater to the growing demand for energy independence and improved grid resilience.

Integration with Green Hydrogen Value Chains: Expanding beyond panel production to offer comprehensive solutions encompassing hydrogen storage, transportation, and utilization unlocks broader market opportunities. Companies actively participating in the entire value chain stand out.

Focus on Material Innovation: Developing low-cost, durable, and efficient materials for electrodes and membranes can significantly reduce production costs and improve system performance. Companies investing in material research gain a competitive edge.

Sustainability and Circular Economy: Utilizing recycled materials in panel manufacturing, minimizing water consumption during electrolysis, and designing for easy recycling and end-of-life management demonstrate environmental commitment and attract sustainability-conscious customers.

Overall Competitive Scenario:

The solar hydrogen panel market is a dynamic and complex space with diverse players employing varied strategies. Technology leaders leverage their expertise, while cost-effective challengers cater to budget-conscious buyers. Regional champions excel in specific markets, and sustainable partnerships drive innovation and market penetration. Factors like technology innovation, affordability, infrastructure integration, and regulatory expertise play a crucial role in market share analysis. New trends like decentralized production, value chain integration, material innovation, and sustainability offer exciting growth opportunities. To succeed in this evolving market, players must prioritize innovation, cater to diverse customer needs, embrace sustainable practices, and actively build partnerships across the hydrogen value chain. By harnessing sunlight and water with efficiency, resourcefulness, and a commitment to clean energy, they can secure a dominant position in this sun-powered landscape.

Sun Hydrogen Inc (as of September 28, 2023):

• Signed a memorandum of understanding (MOU) with the University of Texas at El Paso (UTEP) to collaborate on research and development of solar hydrogen panels. The partnership will focus on developing new materials and processes to improve efficiency and reduce costs. (Source: SunHydrogen press release)

Suzhou GH New Energy Co Ltd (as of December 15, 2023):

• Successfully completed the construction of its first pilot plant for solar hydrogen production. The plant is located in Suzhou, China, and has a capacity of 100 tons of hydrogen per year. (Source: Suzhou GH New Energy website)

Flux50 (as of October 26, 2023):

• Unveiled its next-generation solar hydrogen panel, the Flux50 Pro. The panel boasts a 20% increase in efficiency compared to previous models. (Source: Flux50 press release)

Schmid Group (as of November 17, 2023):

• Entered into a joint venture with the Japanese company Kyocera to develop and manufacture solar hydrogen electrolyzers. The joint venture will leverage Schmid Group's expertise in electrolysis technology and Kyocera's experience in solar cell manufacturing. (Source: Schmid Group press release)

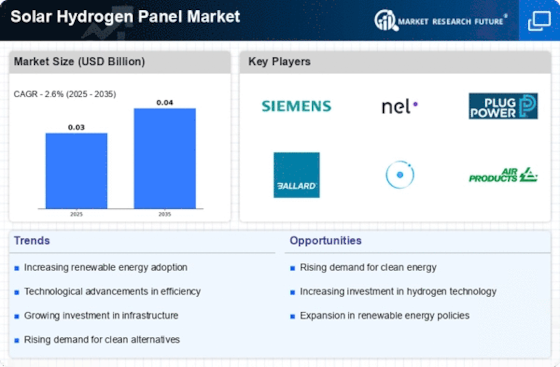

Top listed global companies in the industry are:

Sun Hydrogen Inc, Suzhou GH New Energy Co Ltd, Flux50 and Schmid Group