Health and Wellness Trends

The Global Soft Drink Industry is increasingly influenced by health and wellness trends. As consumers become more health-conscious, there is a noticeable shift towards beverages that offer functional benefits. This includes drinks fortified with vitamins, minerals, and probiotics. In 2025, the market for health-oriented soft drinks is expected to grow significantly, with a projected value of around 150 billion USD. Brands are responding by reformulating existing products to reduce sugar content and eliminate artificial ingredients. This shift not only caters to the demand for healthier options but also aligns with regulatory pressures aimed at reducing sugar consumption. Consequently, companies that adapt to these trends are likely to capture a larger share of the market.

Innovative Flavor Profiles

The Global Soft Drink Industry is witnessing a surge in demand for innovative flavor profiles. Consumers are increasingly seeking unique and exotic flavors that deviate from traditional offerings. This trend is driven by a desire for novel experiences and the influence of social media, where unique beverages gain popularity rapidly. In 2025, the market for flavored soft drinks is projected to reach approximately 200 billion USD, indicating a robust growth trajectory. Companies are investing in research and development to create flavors that appeal to diverse consumer preferences, including tropical fruits, herbal infusions, and even savory notes. This diversification not only attracts new customers but also encourages brand loyalty, as consumers are more likely to return for distinctive taste experiences.

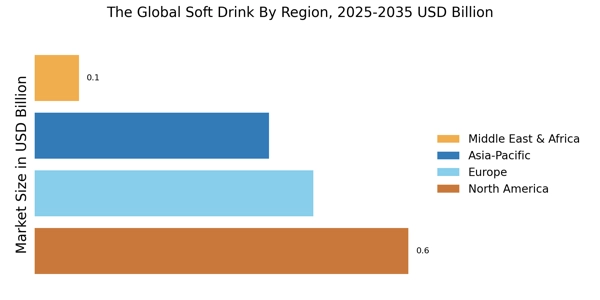

Emerging Markets and Urbanization

The Global Soft Drink Industry is experiencing growth driven by emerging markets and urbanization. As urban populations expand, there is an increasing demand for convenient and accessible beverage options. In 2025, the market in regions such as Asia-Pacific and Latin America is projected to grow at a compound annual growth rate of over 6%. This growth is fueled by rising disposable incomes and changing lifestyles, where soft drinks are becoming a staple in daily consumption. Companies are strategically targeting these regions with tailored marketing campaigns and localized product offerings to cater to diverse tastes and preferences. This focus on emerging markets presents significant opportunities for expansion and revenue generation.

Digital Marketing and E-Commerce Growth

The Global Soft Drink Industry is undergoing a transformation due to the rise of digital marketing and e-commerce. As consumers increasingly turn to online platforms for shopping, brands are adapting their strategies to engage with customers through digital channels. In 2025, e-commerce sales in the beverage sector are expected to account for over 20% of total sales, reflecting a shift in consumer purchasing behavior. Companies are leveraging social media, influencer partnerships, and targeted advertising to reach a broader audience. This digital engagement not only enhances brand visibility but also facilitates direct-to-consumer sales, allowing companies to build stronger relationships with their customers. The integration of technology in marketing strategies is likely to play a crucial role in shaping the future of the soft drink market.

Sustainability and Eco-Friendly Packaging

The Global Soft Drink Industry is increasingly prioritizing sustainability and eco-friendly packaging solutions. As environmental concerns gain prominence, consumers are more inclined to support brands that demonstrate a commitment to sustainability. In 2025, it is estimated that the market for sustainable packaging in the beverage sector will exceed 50 billion USD. Companies are exploring alternatives to traditional plastic, such as biodegradable materials and recyclable packaging. This shift not only addresses consumer preferences but also aligns with global initiatives aimed at reducing plastic waste. Brands that successfully implement sustainable practices are likely to enhance their reputation and attract environmentally conscious consumers, thereby gaining a competitive edge in the market.