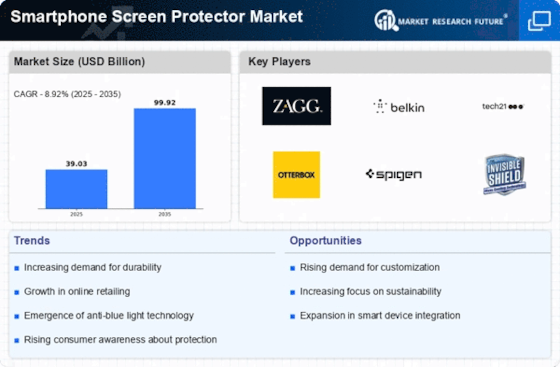

Increased Consumer Awareness

Increased consumer awareness regarding device protection is a notable driver for the Smartphone Screen Protector Market. As consumers become more informed about the potential costs associated with screen repairs, they are more likely to invest in protective accessories. Surveys indicate that a significant percentage of smartphone users prioritize screen protection, with many considering it essential. This heightened awareness is likely to lead to a surge in demand for screen protectors, as consumers seek to safeguard their investments. The Smartphone Screen Protector Market is thus expected to benefit from this trend, as manufacturers capitalize on the growing need for effective protection solutions.

Rising Smartphone Penetration

The increasing penetration of smartphones across various demographics appears to be a primary driver for the Smartphone Screen Protector Market. As more individuals adopt smartphones, the demand for protective accessories, including screen protectors, is likely to rise. Recent data indicates that smartphone ownership has reached approximately 80% in many regions, suggesting a robust market for protective solutions. This trend is particularly pronounced among younger consumers, who are more inclined to invest in accessories that enhance device longevity. Consequently, the Smartphone Screen Protector Market is poised for growth as manufacturers respond to this rising demand with innovative products tailored to diverse consumer preferences.

Customization Trends in Accessories

Customization trends in smartphone accessories are emerging as a significant driver for the Smartphone Screen Protector Market. Consumers are increasingly seeking personalized products that reflect their individual styles and preferences. This trend has led to the introduction of customizable screen protectors, allowing users to select designs, colors, and features that resonate with their personal aesthetics. Market analysis indicates that the demand for personalized accessories is on the rise, with consumers willing to pay a premium for unique products. Consequently, the Smartphone Screen Protector Market is likely to expand as manufacturers innovate to meet this growing demand for customization.

E-commerce Growth and Accessibility

The growth of e-commerce platforms has transformed the way consumers purchase smartphone accessories, including screen protectors. The Smartphone Screen Protector Market is experiencing a shift as online shopping becomes increasingly popular. Data shows that e-commerce sales in the electronics sector have surged, with many consumers preferring the convenience of online shopping. This trend allows for a wider variety of products to be available, catering to diverse consumer preferences. As a result, the Smartphone Screen Protector Market is likely to see increased sales through online channels, enhancing accessibility and driving overall market growth.

Technological Advancements in Screen Protection

Technological advancements in materials and manufacturing processes are significantly influencing the Smartphone Screen Protector Market. Innovations such as tempered glass and self-healing materials have emerged, providing enhanced durability and scratch resistance. For instance, the introduction of anti-blue light and privacy screen protectors has expanded the product range, catering to specific consumer needs. Market data suggests that the demand for high-quality screen protectors is increasing, with a projected growth rate of around 7% annually. This trend indicates that consumers are willing to invest in superior protection, thereby driving the Smartphone Screen Protector Market forward.