Top Industry Leaders in the Smartphone Operating System Market

Smartphone Operating System Market: A Binary Battle for Dominance

The smartphone operating system (OS) market is a two-player battlefield, with iOS and Android dueling for dominance. This dynamic landscape, teeming with billions of users and fierce competition, demands a closer look at the key players, their strategies, and the factors shaping their market share.

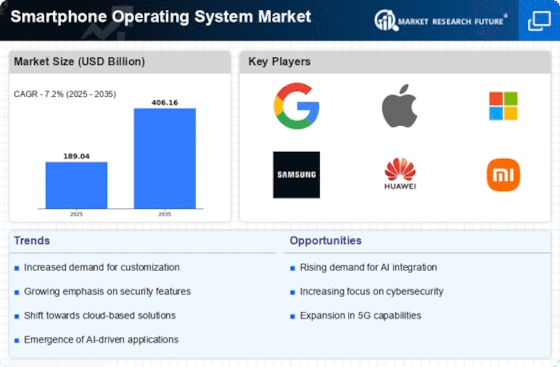

Key Players:

- Google, Inc. (U.S.)

- Apple, Inc. (U.S.)

- Microsoft Corporation (U.S.)

- Blackberry Limited (U.S.)

- Linux Foundation (U.S.)

- Jolla OY (Finland)

- Nokia Corporation (Finland)

- Hewlett Packard (U.S.)

- Qualcomm (U.S.)

- Samsung Electronics (South Korea).

Strategies for Success:

-

Software Innovation: Both players continuously pump out updates with new features, security enhancements, and performance improvements to keep users engaged and attract new ones. -

Ecosystem Expansion: Building robust ecosystems encompassing wearables, smart home devices, and cloud services creates a sticky user experience and fosters customer loyalty. -

App Store Strength: Cultivating a rich and diverse app store with stringent quality control attracts developers and users alike, creating a network effect. -

Emerging Market Focus: Catering to the needs of fast-growing emerging markets with affordable devices and localized features drives market share expansion.

Factors for Market Share Analysis:

-

Device Portfolio Breadth: Offering a range of devices at various price points and specifications caters to diverse customer segments and budgets. -

Carrier and Manufacturer Partnerships: Secure partnerships with major carriers and smartphone manufacturers expands distribution channels and brand visibility. -

Developer and Content Strategy: Attracting and retaining top developers fosters a vibrant app ecosystem, while exclusive content can create a competitive edge. -

Global Presence and Regionalization: Having a strong international presence with localized features and language support is crucial for market dominance.

New and Emerging Companies:

-

Huawei's HarmonyOS: While facing hurdles due to US sanctions, HarmonyOS aims to establish itself as a third contender, leveraging its existing user base and potential integration with its hardware ecosystem. -

Open-Source Alternatives: Rising interest in open-source OS options like LineageOS and GrapheneOS caters to privacy-conscious users and niche communities. -

Wearable and IoT Focus: Smaller players like Tizen (Samsung) and Wear OS (Google) are vying for dominance in the wearable and IoT market, potentially influencing future smartphone OS dynamics.

Current Company Investment Trends:

-

Artificial Intelligence (AI) and Machine Learning (ML): Integrating AI and ML for smarter assistants, context-aware features, and improved security is a major investment focus. -

Augmented Reality (AR) and Virtual Reality (VR): Investing in AR and VR capabilities within smartphone OS could open new avenues for gaming, entertainment, and enterprise applications. -

Foldable and Flexible Displays: Adapting OS to the emerging market of foldable and flexible smartphones creates new user experiences and design possibilities. -

Cybersecurity and Privacy Enhancements: Strengthening security features and addressing privacy concerns remains a top priority to protect user data and build trust.

The Binary Future:

The smartphone OS market is likely to remain a two-horse race for the foreseeable future, with both iOS and Android adapting and innovating to solidify their positions. However, the emergence of new players, growing user concerns about privacy and security, and technological advancements like AI and foldable displays could potentially disrupt the current dominant duopoly. Understanding the competitive landscape, key players' strategies, and emerging trends will be crucial for businesses, developers, and investors to navigate this dynamic and ever-evolving market.

Latest Company Updates:

Android remains the dominant player, holding over 70% of the global market share. Its open-source nature and flexibility make it the go-to choice for a wide range of smartphone manufacturers. (Jan 2024)