Market Trends

Key Emerging Trends in the Smartphone Operating System Market

The smartphone operating system market has been encountering dynamic movements and important patterns lately. As of the most recent appraisals, the two key part, Android and iOS, keep on ruling the scene, however the market has seen unobtrusive changes that show developing inclinations and innovative progressions.

Android, with its open-source nature and far-reaching reception across different gadget makers, keeps up with its fortress as the most generally utilized working framework all around the world. The variety of Android gadgets, going from spending plan cordial choices to premium cell phones, contributes fundamentally to its piece of the pie. Besides, the persistent updates and upgrades in the Android biological system improve client experience and keep the operating system at the very front of development.

Then again, iOS, selective to Apple gadgets, has held a reliable client base, principally attracted to its consistent mix with other Apple items and the biological system's accentuation on protection and security. In spite of having a more modest piece of the pie contrasted with Android, iOS keeps on ordering a top-notch section, catching a huge part of top-of-the-line cell phone clients.

One outstanding pattern in the market is the rising unmistakable quality of option working frameworks. While Android iOS overwhelm, different players, for example, Huawei's HarmonyOS and Samsung's Tizen have been making progress. These choices intend to give clients novel elements and a separated client experience. The progress of these working frameworks generally relies upon their capacity to draw in engineers and make a different application environment.

Another critical pattern is the accentuation on manageability and ecological cognizance in cell phone working frameworks. Both Android and iOS have acquainted highlights with improve battery duration, diminish energy utilization, and advance dependable use. This mirrors a more extensive industry shift towards eco-accommodating works on, resounding with buyers who focus on manageability in their buying choices.

Moreover, the incorporation of man-made brainpower (artificial intelligence) and AI (ML) into cell phone working frameworks is forming the eventual fate of the market. Smart assistants, predictive typing, and personalized recommendations are just a few of the features offered by iOS and Android that make use of these technologies to enhance the user experience. The reconciliation of artificial intelligence works on the effectiveness of cell phones as well as lays the basis for additional complex and instinctive communications among clients and their gadgets.

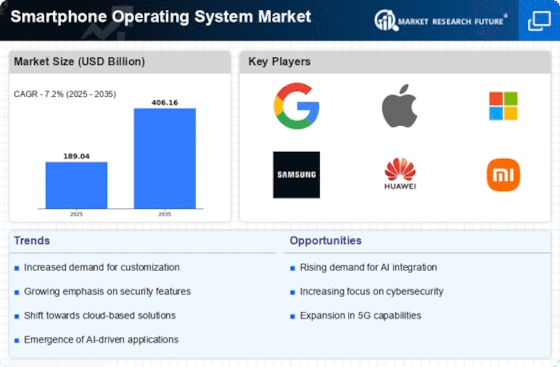

The ascent of 5G innovation is one more powerful component in the smartphone operating system market. As 5G organizations become more boundless, working frameworks are adjusting to bridle the maximum capacity of this innovation. Quicker download speeds, decreased inactivity, and further developed availability are becoming key elements, impacting buyer decisions and forming the advancement needs of working framework suppliers.

All in all, the market is described by a powerful transaction of variables, with Android and iOS keeping up with their predominance yet confronting difficulties from arising players and changing customer inclinations. The industry's pledge to sustainability, the incorporation of AI and ML, the presentation of 5G technology, and the appearance of alternative operating systems all have an bearing on the ever-evolving landscape of the smartphone operating systems. The market is likely to see additional innovations and shifts in the competitive dynamics of this important sector as technology advances.

Leave a Comment