Smart Warehousing Market Summary

As per Market Research Future analysis, the Smart Warehousing Market Size was estimated at 31.2 USD Billion in 2024. The Smart Warehousing industry is projected to grow from USD 35 Billion in 2025 to USD 109.6 Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 12.1% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Smart Warehousing Market is poised for substantial growth driven by automation and technological advancements.

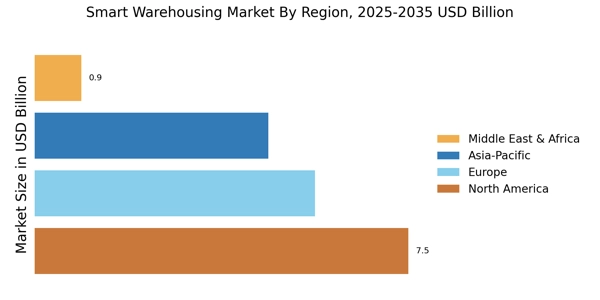

- North America remains the largest market for smart warehousing, reflecting a strong demand for automation and efficiency.

- Asia-Pacific is emerging as the fastest-growing region, propelled by rapid e-commerce expansion and technological adoption.

- The hardware segment continues to dominate the market, while the solutions segment is experiencing the fastest growth due to increasing demand for integrated systems.

- Rising e-commerce demand and labor shortages are key drivers fueling the adoption of smart warehousing solutions.

Market Size & Forecast

| 2024 Market Size | 31.2 (USD Billion) |

| 2035 Market Size | 109.6 (USD Billion) |

| CAGR (2025 - 2035) | 12.1% |

Major Players

Dematic (KION Group), Daifuku, Honeywell Intelligrated, Manhattan Associates, Oracle, SAP, IBM, SSI Schaefer, Knapp, Toyota Industries (Research and Markets)