Rising Demand for Automation

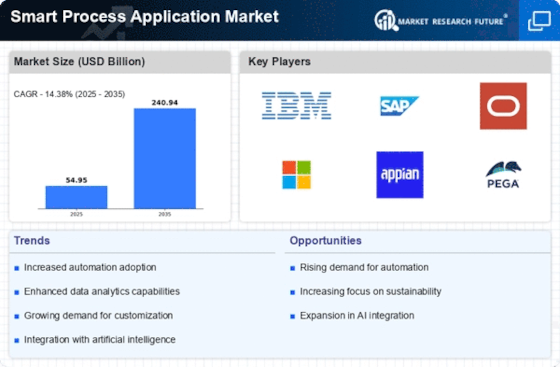

The Smart Process Application Market is experiencing a notable surge in demand for automation solutions. Organizations are increasingly recognizing the need to streamline operations and enhance efficiency. According to recent data, the automation market is projected to grow at a compound annual growth rate of approximately 25% over the next five years. This trend is driven by the desire to reduce operational costs and improve productivity. As businesses seek to optimize their processes, the adoption of smart process applications becomes essential. These applications facilitate the automation of repetitive tasks, allowing employees to focus on more strategic initiatives. Consequently, the Smart Process Application Market is poised for substantial growth as companies invest in technologies that enable seamless automation.

Adoption of Cloud Technologies

The Smart Process Application Market is significantly influenced by the widespread adoption of cloud technologies. Organizations are increasingly migrating their operations to the cloud to benefit from scalability, flexibility, and cost-effectiveness. Recent reports suggest that the cloud computing market is expected to reach a valuation of over 800 billion by 2025. This shift is driving the demand for smart process applications that are cloud-based, enabling businesses to access their processes from anywhere and at any time. The integration of cloud technologies allows for seamless collaboration and real-time updates, enhancing overall operational efficiency. Consequently, the Smart Process Application Market is likely to expand as more organizations recognize the advantages of cloud-based solutions.

Emphasis on Customer Experience

The Smart Process Application Market is increasingly shaped by the emphasis on enhancing customer experience. Organizations are recognizing that delivering exceptional customer service is vital for retaining clients and driving growth. Recent surveys indicate that companies prioritizing customer experience are likely to see a 10% increase in customer retention rates. Smart process applications facilitate the automation of customer interactions, enabling businesses to respond promptly and effectively to customer inquiries. By streamlining processes and improving communication, organizations can create a more personalized experience for their clients. Consequently, the Smart Process Application Market is expected to grow as businesses invest in technologies that enhance customer engagement and satisfaction.

Increased Focus on Data Analytics

In the Smart Process Application Market, there is a growing emphasis on data analytics as organizations strive to make informed decisions. The ability to analyze vast amounts of data in real-time is becoming a critical factor for success. Recent statistics indicate that companies leveraging data analytics are likely to achieve a 20% increase in operational efficiency. This trend is prompting businesses to adopt smart process applications that integrate advanced analytics capabilities. By harnessing data insights, organizations can identify inefficiencies, optimize workflows, and enhance customer experiences. As a result, the Smart Process Application Market is witnessing a shift towards solutions that prioritize data-driven decision-making, ultimately leading to improved performance and competitiveness.

Regulatory Compliance and Risk Management

In the Smart Process Application Market, the increasing complexity of regulatory compliance is a significant driver. Organizations are under constant pressure to adhere to various regulations, which necessitates the implementation of robust risk management strategies. Recent findings indicate that companies investing in compliance technologies can reduce the risk of regulatory fines by up to 30%. Smart process applications play a crucial role in automating compliance processes, ensuring that organizations remain compliant with evolving regulations. This focus on risk management not only protects businesses from potential penalties but also enhances their reputation. As a result, the Smart Process Application Market is likely to see growth as organizations prioritize compliance and risk mitigation through innovative applications.