Aging Population

The Indoor Robots Market is also being shaped by the demographic shift towards an aging population. As the global population ages, there is an increasing need for solutions that assist the elderly in their daily lives. Indoor robots, such as robotic companions and assistive devices, are emerging as valuable tools for enhancing the quality of life for seniors. These robots can provide companionship, assist with household chores, and even monitor health conditions. Market data indicates that the demand for assistive robots is expected to grow significantly, with projections estimating a market expansion of over 25% in the next five years. This trend highlights the potential of the Indoor Robots Market to address the unique needs of an aging demographic, thereby creating new opportunities for innovation and growth.

Sustainability Trends

The Indoor Robots Market is increasingly influenced by sustainability trends as consumers become more environmentally conscious. There is a growing demand for robots that not only perform tasks efficiently but also adhere to sustainable practices. For instance, energy-efficient robotic devices are gaining traction, as they reduce energy consumption and minimize environmental impact. Additionally, the use of recyclable materials in robot manufacturing is becoming a focal point for many companies within the Indoor Robots Market. Market Research Future suggests that the sustainability aspect could drive a significant portion of consumer purchasing decisions, with an estimated 40% of consumers willing to pay a premium for eco-friendly products. This shift towards sustainability is likely to shape the future of the Indoor Robots Market, encouraging innovation and responsible practices among manufacturers.

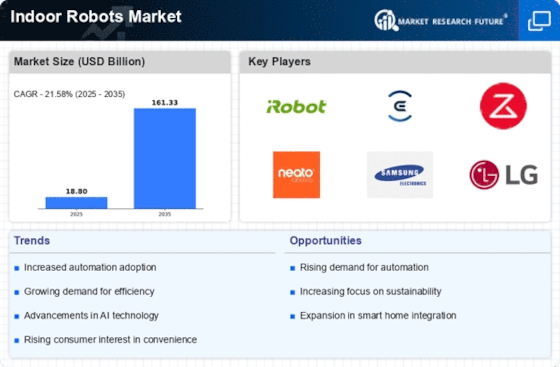

Technological Advancements

The Indoor Robots Market is experiencing rapid technological advancements that enhance the functionality and efficiency of robots. Innovations in artificial intelligence, machine learning, and sensor technology are driving the development of more sophisticated indoor robots. For instance, the integration of advanced navigation systems allows robots to operate seamlessly in complex environments. According to recent data, the market for indoor robots is projected to grow at a compound annual growth rate of approximately 20% over the next five years. This growth is indicative of the increasing demand for automation in domestic and commercial settings, as consumers seek solutions that simplify their daily tasks. As technology continues to evolve, the Indoor Robots Market is likely to witness the emergence of new applications and capabilities, further expanding its reach and appeal.

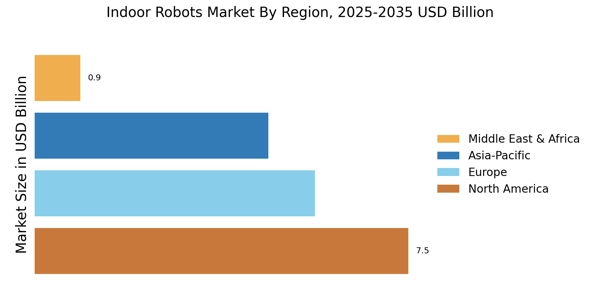

Rising Demand for Automation

The Indoor Robots Market is significantly influenced by the rising demand for automation across various sectors. As consumers and businesses alike seek to enhance productivity and efficiency, the adoption of indoor robots is becoming more prevalent. This trend is particularly evident in households, where robotic vacuum cleaners and lawn mowers are gaining popularity. Market data suggests that the residential segment of the Indoor Robots Market is expected to account for a substantial share, driven by the convenience and time-saving benefits these devices offer. Furthermore, the commercial sector is also embracing automation, with robots being utilized for tasks such as inventory management and cleaning services. This growing inclination towards automation indicates a shift in consumer behavior, which is likely to propel the Indoor Robots Market to new heights in the coming years.

Increased Focus on Smart Homes

The Indoor Robots Market is witnessing a notable increase in the focus on smart home technologies. As consumers become more inclined towards creating interconnected living spaces, the demand for indoor robots that can seamlessly integrate with smart home systems is on the rise. Devices such as robotic vacuum cleaners and home assistants are being designed to work in harmony with other smart devices, enhancing user experience and convenience. Market analysis indicates that the smart home segment is expected to contribute significantly to the growth of the Indoor Robots Market, with projections suggesting a market size increase of over 30% in the next few years. This trend reflects a broader movement towards home automation, where indoor robots play a crucial role in simplifying household management and improving overall quality of life.