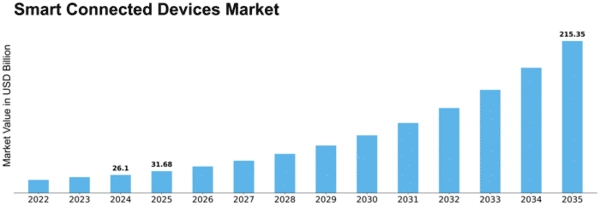

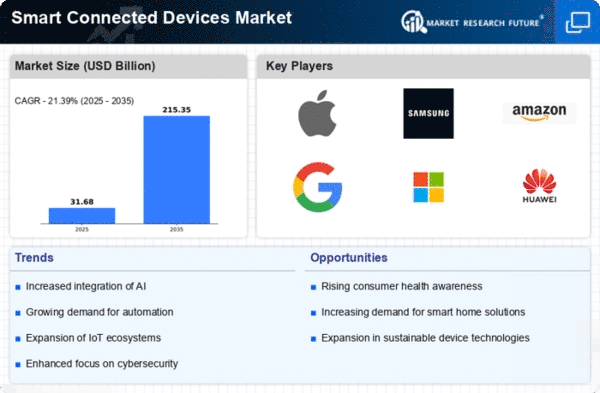

Smart Connected Devices Size

Smart Connected Devices Market Growth Projections and Opportunities

The Smart Connected Devices Market is profoundly influenced by various market factors that collectively shape its growth and evolution. One pivotal driver is the increasing demand for connectivity and seamless integration of smart devices into daily life. The surge in consumer preferences for smart homes, wearables, and connected appliances has fueled the market's expansion. The desire for enhanced convenience, efficiency, and the ability to control devices remotely drives the adoption of smart connected devices across diverse sectors.

Technological advancements play a central role in propelling the Smart Connected Devices Market forward. The continuous evolution of wireless communication technologies, such as Bluetooth, Wi-Fi, and 5G, enhances the connectivity and interoperability of smart devices. Additionally, the integration of advanced sensors, artificial intelligence (AI), and Internet of Things (IoT) technologies contributes to the intelligence and autonomy of smart connected devices. This technological convergence enables devices to collect and analyze data, adapt to user preferences, and communicate seamlessly within smart ecosystems.

The rise of smart homes is a significant contributor to the growth of the Smart Connected Devices Market. Home automation systems, connected security devices, smart lighting, and thermostats are increasingly becoming integral components of modern households. The convenience of controlling various aspects of home environments through smartphones and voice-activated assistants contributes to the widespread adoption of smart connected devices in residential settings.

The healthcare sector is another pivotal driver for the Smart Connected Devices Market. Wearable devices, such as fitness trackers and smartwatches, enable individuals to monitor their health in real-time, promoting preventive healthcare practices. The integration of smart medical devices, like remote patient monitoring systems and connected insulin pumps, enhances healthcare delivery by providing continuous data to healthcare professionals. The growing emphasis on telemedicine and remote patient care further amplifies the role of smart connected devices in the healthcare landscape.

Government initiatives and regulatory support also influence the Smart Connected Devices Market. Policies promoting smart city initiatives, energy efficiency, and digital transformation contribute to the integration of connected devices in urban planning, transportation, and public services. Additionally, regulatory frameworks ensuring data privacy and security play a crucial role in shaping the market, as consumers and businesses prioritize the protection of their sensitive information.

The industrial sector embraces the concept of Industry 4.0, driving the adoption of smart connected devices in manufacturing processes. The implementation of IoT-enabled sensors and connected machinery enhances automation, improves operational efficiency, and enables predictive maintenance. Smart connected devices contribute to the evolution of smart factories, where real-time data analytics and connectivity streamline production processes and facilitate agile decision-making.

Leave a Comment