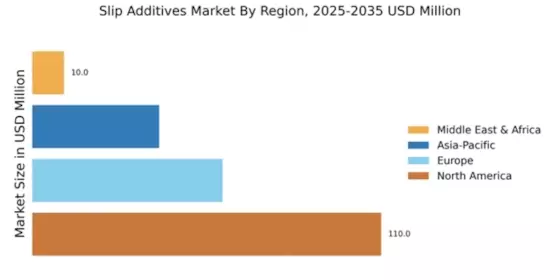

North America : Market Leader in Slip Additives

North America is poised to maintain its leadership in the slip additives market, holding a significant share of 110.0 million. The region's growth is driven by increasing demand in packaging and automotive sectors, alongside stringent regulations promoting the use of eco-friendly additives. The focus on sustainability and innovation is further propelling market expansion, with companies investing in R&D to develop advanced slip additives that meet regulatory standards.

The United States stands as the largest market, supported by key players like BASF SE, Honeywell International Inc., and Eastman Chemical Company. These companies are leveraging technological advancements to enhance product performance and meet diverse customer needs. The competitive landscape is characterized by strategic partnerships and mergers, aimed at expanding product portfolios and market reach, ensuring North America's continued dominance in the slip additives sector.

Europe : Emerging Market with Growth Potential

Europe's slip additives market is experiencing robust growth, with a market size of 60.0 million. The region is witnessing increased demand driven by the packaging and consumer goods industries, alongside regulatory frameworks that encourage the use of sustainable materials. The European Union's commitment to reducing plastic waste is catalyzing innovation in slip additives, pushing manufacturers to develop eco-friendly solutions that comply with new regulations.

Germany and France are leading the charge in this market, with major players like Evonik Industries AG and Clariant AG at the forefront. The competitive landscape is marked by a focus on sustainability and product differentiation, as companies strive to meet the evolving needs of consumers. The presence of established manufacturers and a growing number of startups is fostering a dynamic environment, positioning Europe as a key player in The Slip Additives.

Asia-Pacific : Rapid Growth in Emerging Economies

The Asia-Pacific region is witnessing significant growth in the slip additives market, with a market size of 40.0 million. This growth is fueled by rising industrialization and urbanization, particularly in countries like China and India. The increasing demand for packaging materials and automotive components is driving the need for effective slip additives. Additionally, supportive government policies aimed at enhancing manufacturing capabilities are further propelling market expansion in this region.

China is the dominant player in the Asia-Pacific slip additives market, with a strong presence of local and international companies. Key players such as Wacker Chemie AG and Kraton Corporation are actively investing in R&D to innovate and improve product offerings. The competitive landscape is characterized by a mix of established firms and emerging players, creating a vibrant market environment that is expected to grow substantially in the coming years.

Middle East and Africa : Niche Market with Growth Opportunities

The Middle East and Africa region represents a niche market for slip additives, with a market size of 10.0 million. The growth in this region is primarily driven by increasing demand in the packaging and construction sectors. As industries evolve, there is a growing recognition of the importance of slip additives in enhancing product performance and sustainability. Government initiatives aimed at diversifying economies are also contributing to market growth, encouraging investments in manufacturing and chemical production.

Countries like South Africa and the UAE are emerging as key players in the slip additives market, with a focus on developing local manufacturing capabilities. The competitive landscape is still developing, with opportunities for both local and international companies to establish a foothold. As the market matures, the presence of key players and strategic partnerships will be crucial for capturing growth opportunities in this region.