Slip Additives Size

Slip Additives Market Growth Projections and Opportunities

Several factors affect the dynamics of Slip Additives Market. Increased demand for these products by end-use industries such as packaging, automotive and food processing is one of the main drivers. This goes hand in hand with increased growth in these industries which calls for greater investment in slip additives. Slip additives modify surface properties of materials; they minimize friction and make them more slippery. For example, smooth packages are easier to process and handle materials effectively when compared to rough ones. In addition, the automotive industry utilizes slip additives to assist performance enhancements in interiors and ease the manufacture of parts.

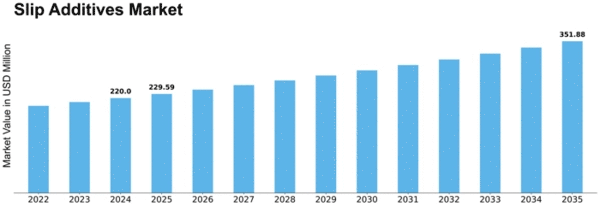

The market size for Slip Additives was $0.2 billion as at 2022.The Slip Additives market industry is projected to grow from USD0.21 Billion in 2023 to USD 0.310265643 billion by 2032, exhibitinga compound annual growth rate (CAGR) of 5.00%

Another significant factor impacting the Slip Additives Market is the growing awareness and emphasis on sustainable practices. Sustainable development concerns have led to an increasing demand for environmentally friendly materials across a range of industries.Slip additives play a crucial role in improving the processing characteristics of these kinds of green material making them suitable for applications. To make bio-based or recycled plastics more attractive manufacturers have started introducing slip additives to improve slip + anti-block properties thus aligning with global pursuit towards a more sustainable circular economy.

Also, regulatory landscape has a big influence on Slip Additives market.Government regulations that exist concerning food safety, emissions and packaging wield substantial impact on what types of additive slips will be employed.For instance, there are very strict rules governing those additives used on food packages because they must ensure that consumer goods packed within them comply with necessary health standards.In addition there exists laws concerning car emission limits or otherwise allowed substances used here.Manufacturers have always had to familiarize themselves with such norms while modifying their product formulations so that they remain compliant, which ultimately influences the entire market.

The market dynamics of slip additives are also influenced by changing consumer preferences and lifestyle.Consumer awareness towards quality and performance of products is increasing, leading to manufacturers incorporating advanced additives in their products.Slip additives significantly improve aesthetics and functionality of consumer goods; therefore, consumers demand more personalized slip additives as people start looking for things that are more innovative and of higher quality.

Furthermore, the global economic scenario significantly shapes the Slip Additives Market. Economic fluctuations, trade policies and currency exchange rates determine production patterns around the world. For example during economic downturns manufacturing activities may slow down causing a temporary dip in the demand for slip additives. On the other hand, when economies expand along with increased business activity it usually leads to a rise in demand for such chemicals due to greater number of manufactured items.

Leave a Comment