Single Use Bioprocessing Size

Single Use Bioprocessing Market Growth Projections and Opportunities

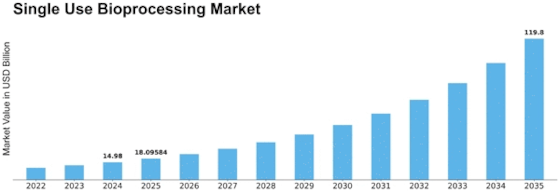

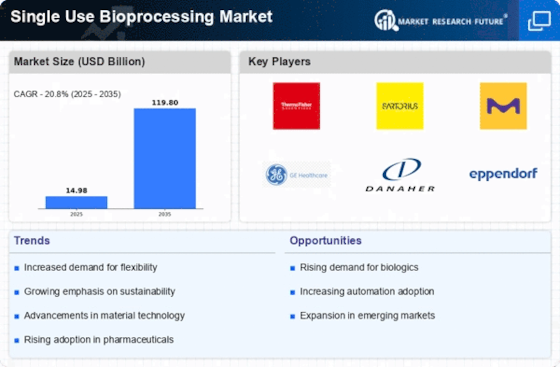

The Single Use bioprocessing Market has a market size of USD 46.56 billion and it is estimated to grow at 20.8% CAGR during the period from 2023-2032. As the Single-Use Bioprocessing Market proceeds in constant growth, a range of factors that present an increasing demand for single-use technologies in biopharmaceutical manufacturing are responsible for the market expansion. The key reason is of course the necessity of flexibility and efficiency in bioprocessing operations. The advantage of single-use bioprocessing systems include disposable bags, bioreactors, and tubing sets that provide a flexible scalable manufacturing approach that can facilitate faster turnaround times, lower contamination risks, and higher operation efficiency. This adaptability plays a significant role in biopharmaceutical production in the face of dynamic scenarios of scale of production and processes modifications.

Technologies and innovations are centerpieces of the development of Single-Use Bioprocessing Market. There is a plethora of new materials, more efficient designs, and advanced functions that make single-use bioprocessing equipment a preferred choice of many. Bioprocessing manufacturers are into developing new single-use technologies that in turn will solve the specific challenges of biomanufacturing such as scalability, robustness and compatibility with other processes.

Cost-effectiveness of single-use bioprocessing systems also contributes to the market factor. Bioprocessing technology relies on conventional stainless-steel devices that require a substantial amount of money to be invested upfront, whilst also facing long setup time as well as complex cleaning and validation procedures. One of the advantages of using single-use platforms is that the systems do not require extensive cleaning and validation, thereby lowering downtime between batches and operating costs. The overall cost effectiveness of simpler technologies makes them a very attractive choice not only for well-established pharmaceutical companies but also for emerging biotech startups.

The other market aspect relates to the prevailing trend of biopharmaceutical outsourcing and contract manufacturing arrangements. Due to the increasing number of CMOs using single-use bioprocessing technologies, they can manufacture cost-effective and flexible processing solutions. The implementation of single-use bioprocess technologies enables CMOs to adjust quickly to fluctuating customer requirements, to utilize resources appropriately, and to set more cost-effective pricing for the production of biopharmaceuticals.

The regulatory support and industry standards are the key factors that should be taken into account within the Single-Use Bioprocessing Market. The regulatory authorities acknowledge the benefits of the single-use technologies, granted that they satisfy all the specific mandates. The alignment of industry standards and regulatory frameworks maintain the reliability and consistency of the single-use bioprocessing systems, and due to this manufacturers feel safe to adopt such instruments for the production of therapeutic biologics.

Leave a Comment