Regulatory Support

Regulatory support is emerging as a crucial driver for the Single Trip Travel Insurance Market. Governments are increasingly recognizing the importance of travel insurance in protecting consumers and promoting safe travel practices. In several regions, regulations are being implemented to encourage travelers to obtain insurance coverage before embarking on their journeys. This regulatory push not only enhances consumer protection but also fosters a more robust insurance market. As a result, the Single Trip Travel Insurance Market is expected to benefit from these supportive measures, leading to increased adoption of travel insurance among consumers.

Rising Travel Demand

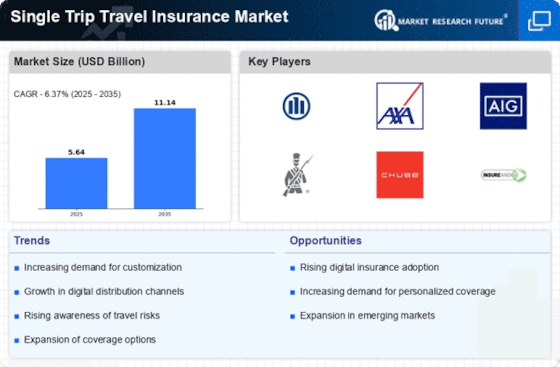

The Single Trip Travel Insurance Market is experiencing a notable surge in demand, driven by an increase in travel activities. As individuals seek to explore new destinations, the need for travel insurance becomes paramount. In recent years, the number of international travelers has risen significantly, with estimates indicating that over 1.4 billion people traveled abroad in 2020. This trend suggests a growing awareness of the importance of safeguarding against unforeseen events during trips. Consequently, the Single Trip Travel Insurance Market is likely to benefit from this rising travel demand, as more travelers recognize the necessity of insurance coverage to mitigate risks associated with travel.

Increased Risk Awareness

There is a growing awareness among travelers regarding the potential risks associated with travel, which is significantly influencing the Single Trip Travel Insurance Market. Events such as natural disasters, political instability, and health emergencies have heightened concerns about safety while traveling. As a result, travelers are more inclined to invest in insurance coverage that provides peace of mind during their trips. Market data suggests that nearly 70% of travelers now consider insurance a necessary part of their travel planning. This heightened risk awareness is likely to drive growth in the Single Trip Travel Insurance Market, as more individuals seek protection against unforeseen circumstances.

Technological Advancements

Technological advancements are playing a pivotal role in shaping the Single Trip Travel Insurance Market. The integration of digital platforms and mobile applications has streamlined the purchasing process, making it more accessible for consumers. Data from recent studies indicate that approximately 60% of travelers prefer to purchase insurance online, highlighting the importance of technology in this sector. Furthermore, the use of artificial intelligence and data analytics allows insurers to better assess risks and tailor policies accordingly. As technology continues to evolve, the Single Trip Travel Insurance Market is likely to see increased efficiency and customer satisfaction, driving further growth.

Evolving Consumer Preferences

Consumer preferences are evolving, with travelers increasingly seeking tailored insurance solutions that cater to their specific needs. The Single Trip Travel Insurance Market is adapting to these changing preferences by offering customizable policies that allow consumers to select coverage options that align with their travel plans. This shift is evidenced by a growing number of insurance providers who are enhancing their offerings to include features such as adventure sports coverage and trip cancellation benefits. As consumers become more discerning, the Single Trip Travel Insurance Market is poised to expand, as personalized insurance solutions resonate with the modern traveler.