Rising Travel Expenditure

The Travel Credit Insurance Market is experiencing growth due to the increasing expenditure on travel. As disposable incomes rise, consumers are more willing to invest in travel experiences, leading to a surge in demand for travel insurance products. In 2025, it is estimated that the average household travel expenditure has increased by approximately 15% compared to previous years. This trend indicates that more travelers are seeking protection against unforeseen events, thereby driving the need for comprehensive travel credit insurance. The rising travel expenditure not only reflects a growing interest in leisure and business travel but also highlights the importance of safeguarding investments made in travel plans. Consequently, the Travel Credit Insurance Market is likely to benefit from this upward trajectory in travel spending.

Increased Regulatory Support

The Travel Credit Insurance Market is bolstered by enhanced regulatory frameworks that promote consumer protection. Governments are increasingly recognizing the necessity of travel insurance, leading to policies that encourage travelers to secure coverage. For instance, regulations mandating the inclusion of travel insurance in certain travel packages have emerged, thereby increasing the penetration of travel credit insurance. This regulatory support not only fosters consumer confidence but also stimulates market growth. As more travelers become aware of their rights and the benefits of insurance, the demand for travel credit insurance is expected to rise. The alignment of regulatory measures with consumer needs suggests a promising future for the Travel Credit Insurance Market.

Growing Awareness of Travel Risks

The Travel Credit Insurance Market is experiencing growth due to heightened awareness of travel-related risks among consumers. As travelers become more informed about potential disruptions, such as trip cancellations, medical emergencies, and lost luggage, the demand for travel credit insurance is likely to increase. Surveys indicate that approximately 70% of travelers now consider insurance a necessary component of their travel plans. This shift in perception underscores the importance of protecting investments made in travel arrangements. Consequently, the Travel Credit Insurance Market is poised to expand as more consumers recognize the value of securing coverage against unforeseen events.

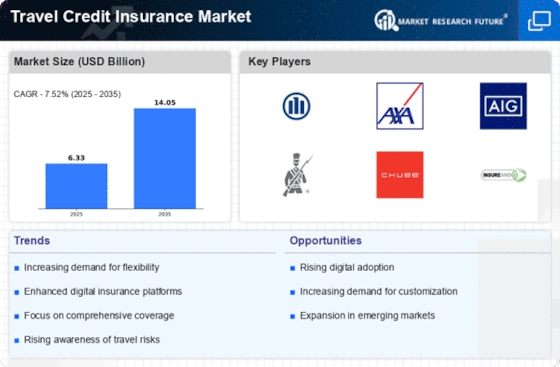

Technological Advancements in Insurance

The Travel Credit Insurance Market is significantly influenced by technological advancements that enhance the purchasing experience for consumers. The integration of digital platforms and mobile applications allows travelers to easily compare insurance products, read reviews, and purchase policies online. In 2025, it is projected that over 60% of travel insurance purchases will occur through digital channels, reflecting a shift in consumer behavior. This technological evolution not only streamlines the buying process but also provides consumers with access to tailored insurance solutions that meet their specific needs. As technology continues to evolve, the Travel Credit Insurance Market is likely to see increased competition and innovation, ultimately benefiting consumers.

Customization and Personalization of Insurance Products

The Travel Credit Insurance Market is evolving with a trend towards customization and personalization of insurance products. Insurers are increasingly offering tailored policies that cater to the unique needs of individual travelers. This shift is driven by consumer demand for more flexible options that align with their specific travel plans and preferences. In 2025, it is anticipated that personalized travel credit insurance products will account for a significant portion of the market, as travelers seek coverage that reflects their unique circumstances. This trend not only enhances customer satisfaction but also fosters loyalty, as consumers are more likely to return to providers that offer customized solutions. The emphasis on personalization is likely to shape the future of the Travel Credit Insurance Market.