Customization Trends

Customization and personalization are emerging as key trends within The Global Siding Industry. Homeowners are increasingly seeking unique designs that reflect their individual tastes and preferences. This shift is prompting manufacturers to offer a wider array of colors, textures, and finishes, allowing for greater creative expression in home exteriors. The demand for customized siding solutions is particularly pronounced in the residential sector, where homeowners are willing to invest in high-quality materials that enhance curb appeal. Market data suggests that the segment for customized siding is expanding, with a notable increase in sales attributed to this trend. As a result, companies that can provide tailored solutions are likely to gain a competitive edge in the evolving market landscape.

Regulatory Compliance

Regulatory compliance is becoming increasingly important in The Global Siding Industry, as governments worldwide implement stricter building codes and environmental regulations. These regulations often mandate the use of specific materials and construction practices that promote safety and sustainability. Consequently, manufacturers are compelled to adapt their product offerings to meet these evolving standards. This shift not only influences the types of materials used in siding but also drives innovation in product development. For instance, siding products that meet fire resistance and energy efficiency standards are gaining popularity, as they align with regulatory requirements. The market is likely to see continued growth in this area, as compliance becomes a critical factor in purchasing decisions for both builders and consumers.

Technological Innovations

Technological advancements are transforming The Global Siding Industry, leading to the development of innovative materials and installation techniques. The introduction of smart siding solutions, which incorporate sensors and IoT technology, is gaining traction among consumers seeking enhanced functionality. These innovations not only improve the durability and performance of siding materials but also offer energy-saving benefits. For instance, insulated siding products are becoming increasingly popular, as they provide superior thermal performance, potentially reducing heating and cooling costs for homeowners. The market is expected to see a surge in demand for these technologically advanced products, with projections indicating a significant increase in market share for smart siding solutions over the next few years.

Sustainability Initiatives

The increasing emphasis on sustainability is a pivotal driver in the siding market. As consumers and builders alike prioritize eco-friendly materials, the demand for sustainable siding options is on the rise. This trend is reflected in the growing market for materials such as fiber cement and reclaimed wood, which are perceived as environmentally responsible choices. The Global Siding Industry is witnessing a shift towards products that not only meet aesthetic needs but also contribute to energy efficiency and reduced carbon footprints. In fact, the market for sustainable siding is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 5% in the coming years. This focus on sustainability is likely to reshape product offerings and influence purchasing decisions across various segments.

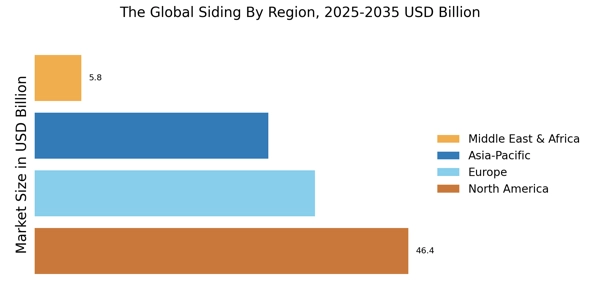

Economic Growth and Urbanization

Economic growth and urbanization are significant drivers of The Global Siding Industry. As urban areas expand and populations increase, the demand for new residential and commercial construction rises. This trend is particularly evident in developing regions, where rapid urbanization is leading to a surge in construction activities. The siding market is poised to benefit from this growth, as builders seek durable and aesthetically pleasing materials to meet the needs of new developments. Market analysis indicates that the siding sector is likely to experience robust growth, with projections suggesting an increase in demand for various siding materials, including vinyl, wood, and metal. This economic momentum is expected to sustain the market's upward trajectory in the coming years.