Economic Growth and Housing Demand

Japan's economic growth is a crucial driver of the siding market, as it correlates with increased housing demand. The country's economy has shown resilience, leading to a rise in disposable income and consumer spending. This economic environment encourages home renovations and new constructions, thereby boosting the demand for siding materials. The housing market is projected to grow by 2.5% annually, which will likely enhance the siding market as homeowners invest in quality siding solutions. Additionally, the trend towards energy-efficient homes is prompting consumers to opt for siding that offers insulation benefits, further driving market growth. As economic conditions improve, the siding market is expected to thrive, with an estimated increase in sales volume by 10% over the next few years.

Regulatory Compliance and Standards

The siding market in Japan is increasingly influenced by stringent regulatory compliance and standards aimed at enhancing building safety and environmental sustainability. The Japanese government has implemented various building codes that mandate the use of fire-resistant and energy-efficient materials. This regulatory landscape encourages manufacturers to innovate and produce siding solutions that meet these requirements. As a result, the market is witnessing a shift towards materials that not only comply with safety standards but also contribute to energy conservation. The emphasis on compliance is expected to drive growth in the siding market, as builders and contractors seek materials that align with these regulations, potentially increasing market value by an estimated 15% over the next five years.

Consumer Preferences for Aesthetic Appeal

In Japan, consumer preferences are shifting towards aesthetic appeal in home exteriors, significantly impacting the siding market. Homeowners are increasingly seeking siding materials that not only provide functionality but also enhance the visual appeal of their properties. This trend is evident in the rising popularity of wood, vinyl, and fiber cement siding, which offer diverse design options. Market Research Future indicates that approximately 40% of consumers prioritize aesthetics when selecting siding materials. This growing emphasis on design is prompting manufacturers to innovate and offer a wider range of colors, textures, and styles. As a result, the siding market is likely to experience a surge in demand for visually appealing products, potentially increasing market share by 20% in the coming years.

Technological Innovations in Manufacturing

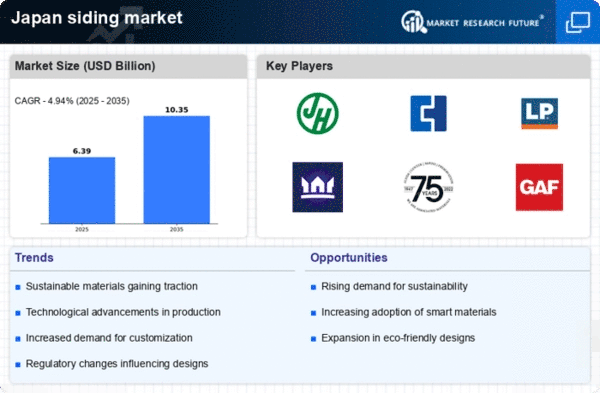

Technological innovations in manufacturing processes are transforming the siding market in Japan. Advances in production techniques, such as automation and the use of sustainable materials, are enhancing the efficiency and quality of siding products. Manufacturers are increasingly adopting technologies that reduce waste and energy consumption, aligning with the growing demand for eco-friendly solutions. This shift not only improves product quality but also lowers production costs, making siding materials more accessible to consumers. The integration of smart technologies in siding products, such as moisture detection and thermal regulation, is also gaining traction. These innovations are likely to drive the siding market forward, with a projected growth rate of 5% annually as manufacturers respond to evolving consumer needs and environmental considerations.

Urbanization and Infrastructure Development

Japan's rapid urbanization and ongoing infrastructure development are pivotal drivers of the siding market. As cities expand and new residential and commercial projects emerge, the demand for high-quality siding materials is on the rise. Urban areas are increasingly characterized by modern architectural designs that require innovative siding solutions. The construction sector in Japan is projected to grow at a CAGR of 3.5% through 2026, which will likely bolster the siding market. This growth is further fueled by government initiatives aimed at revitalizing urban spaces, leading to increased investments in construction projects. Consequently, the siding market is poised to benefit from this urban expansion, as builders seek durable and aesthetically pleasing siding options.