Growth of the E-Waste Recycling Sector

The Global Shredder Blades Market Industry is significantly impacted by the rapid expansion of the e-waste recycling sector. With the increasing volume of electronic waste generated globally, there is a pressing need for efficient shredding solutions to recover valuable materials. In 2024, the e-waste recycling market is expected to contribute substantially to the overall recycling industry, which is projected to reach 531.5 USD Billion. Shredder blades designed specifically for e-waste applications are essential for processing complex materials, including circuit boards and batteries. This growth presents opportunities for manufacturers to innovate and develop specialized blades, thereby enhancing their market presence within the Global Shredder Blades Market Industry.

Regulatory Support for Waste Management

The Global Shredder Blades Market Industry benefits from increasing regulatory support aimed at enhancing waste management practices. Governments worldwide are implementing stricter regulations to promote recycling and reduce landfill waste, which in turn drives demand for shredding technologies. For instance, policies encouraging the recycling of plastics and electronic waste create a favorable environment for the adoption of advanced shredding solutions. As these regulations become more stringent, industries are compelled to invest in efficient shredding equipment, including high-performance blades. This regulatory landscape is likely to foster growth in the Global Shredder Blades Market Industry, as companies seek to comply with evolving standards and enhance their sustainability efforts.

Increasing Demand for Recycling Solutions

The Global Shredder Blades Market Industry experiences a surge in demand driven by the growing emphasis on recycling and waste management. As nations strive to meet environmental regulations and sustainability goals, the need for efficient shredding solutions becomes paramount. For instance, the global recycling market is projected to reach 531.5 USD Billion in 2024, indicating a robust growth trajectory. Shredder blades play a crucial role in this process, enabling the effective processing of various materials, including plastics and metals. Consequently, manufacturers are focusing on developing advanced blades that enhance shredding efficiency and durability, thereby supporting the overall growth of the Global Shredder Blades Market Industry.

Rising Industrialization and Urbanization

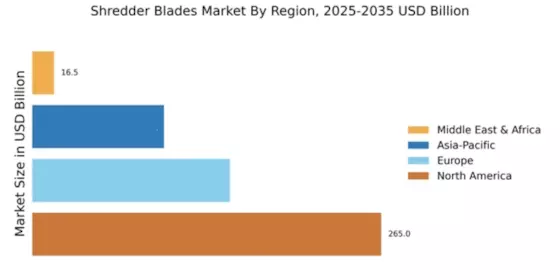

The Global Shredder Blades Market Industry is poised for growth due to the accelerating pace of industrialization and urbanization worldwide. As urban areas expand and industries proliferate, the volume of waste generated increases, necessitating efficient waste management solutions. This trend is particularly evident in developing countries, where urbanization rates are high. The demand for shredding equipment, including high-quality blades, is likely to rise as businesses seek to comply with environmental regulations and optimize waste disposal processes. The projected compound annual growth rate (CAGR) of 5.9% from 2025 to 2035 underscores the potential for growth in the Global Shredder Blades Market Industry as it adapts to these changing dynamics.

Technological Advancements in Blade Manufacturing

Technological innovations significantly influence the Global Shredder Blades Market Industry, as manufacturers adopt advanced materials and production techniques. The introduction of high-performance alloys and coatings enhances blade longevity and efficiency, catering to diverse shredding applications. For example, the integration of computer-aided design (CAD) and computer numerical control (CNC) machining allows for precision engineering of blades, resulting in improved performance. These advancements not only reduce operational costs but also contribute to the sustainability of shredding processes. As the industry evolves, the focus on innovation is likely to propel the market forward, aligning with the projected growth of the Global Shredder Blades Market Industry.