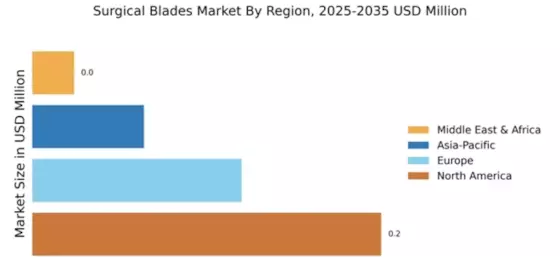

North America : Market Leader in Surgical Blades

North America is poised to maintain its leadership in the surgical blades market, holding a significant share of 255.0 million in 2024. The region's growth is driven by advanced healthcare infrastructure, increasing surgical procedures, and a rising demand for minimally invasive surgeries. Regulatory support and innovation in surgical technologies further enhance market dynamics, making it a hub for surgical advancements.

The competitive landscape in North America is characterized by the presence of major players such as Johnson & Johnson and Medtronic plc. These companies are investing heavily in R&D to develop innovative surgical solutions. The U.S. remains the largest market, supported by a high volume of surgical procedures and a focus on patient safety and quality. The regulatory environment is conducive, ensuring that products meet stringent safety standards, thus fostering market growth.

Europe : Emerging Market with Growth Potential

Europe's surgical blades market is valued at 130.0 million, reflecting a growing demand driven by an aging population and increasing healthcare expenditure. The region is witnessing a shift towards advanced surgical techniques, including robotic-assisted surgeries, which are propelling the demand for high-quality surgical blades. Regulatory frameworks in Europe are also evolving to support innovation while ensuring patient safety, thus acting as a catalyst for market growth.

Leading countries in this region include Germany, France, and the UK, where healthcare investments are robust. Key players like B. Braun Melsungen AG and Smith & Nephew plc are actively expanding their product portfolios to cater to diverse surgical needs. The competitive landscape is marked by collaborations and partnerships aimed at enhancing product offerings and market reach. The European market is expected to grow steadily as healthcare systems adapt to new technologies and patient demands.

Asia-Pacific : Rapidly Growing Surgical Market

The Asia-Pacific surgical blades market, valued at 100.0 million, is experiencing rapid growth due to increasing healthcare investments and a rising number of surgical procedures. The region's expanding population and improving healthcare infrastructure are significant growth drivers. Additionally, government initiatives aimed at enhancing healthcare access and quality are fostering a favorable environment for market expansion, making it a key player in the global landscape.

Countries like Japan, China, and India are leading the charge, with a growing number of healthcare facilities and a focus on advanced surgical techniques. Key players such as Terumo Corporation and Nipro Corporation are capitalizing on this growth by introducing innovative products tailored to local needs. The competitive landscape is becoming increasingly dynamic, with both local and international companies vying for market share, thus enhancing the overall market potential.

Middle East and Africa : Emerging Market with Challenges

The Middle East and Africa surgical blades market, valued at 25.0 million, is emerging but faces challenges such as limited healthcare infrastructure and varying regulatory environments. However, the region is witnessing a gradual increase in surgical procedures driven by a growing population and rising healthcare investments. Governments are focusing on improving healthcare access, which is expected to boost demand for surgical blades in the coming years.

Countries like South Africa and the UAE are leading the market, with increasing investments in healthcare facilities and technology. Key players such as Hollister Incorporated are working to establish a stronger presence in the region. The competitive landscape is characterized by a mix of local and international companies, with efforts to enhance product availability and quality, thus paving the way for future growth.