By region, the study provides market insights into North America, Europe, Asia-Pacific, and Rest of the World. North America experience significant growth with the rising number of research and development activities for developing innovative technology-based designs of portable warfare systems. Advancement in technology in the warfare platform is boosting the growth of the North America shoulder-fired weapon market. The adoption of man-portable anti-tank weapons, as well as a man-portable air defense system, provides an advantage to troops by destroying targets without concern about the precision of the strike as well as the weight of the weapon.

With the increase in the use of sophisticated armored machinery in war, various countries are increasing their adoption of MANPADS. Advanced MANPADS are installed with ultraviolet sensors for the detection of radiation, infrared sensors for smart control units, and heat detection.

The common MANPADS are infrared seekers which acquire the targets by detecting of aircraft engine heat. Modern MANPADS include Igla and Strela weapons, as well as stinger shoulder weapons. The military conflict between Ukraine and Russia has driven some developments in terms of the procurement and supply of shoulder-fired weapons. For example, in May 2022, The US government planned for supplying thousand of javelin and stinger shoulder-fired weapons to Ukraine. Additionally country has placed orders for javelin in May 2022. These weapons are produced in partnership between Lockheed Martin and Raytheon.

Furthermore, with rising incidents of drone strikes as well as air space intrusions, forces across the world are seeking innovative MANPADS for air defense.

Further, the major countries studied in the market report are The U.S, Canada, Germany, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

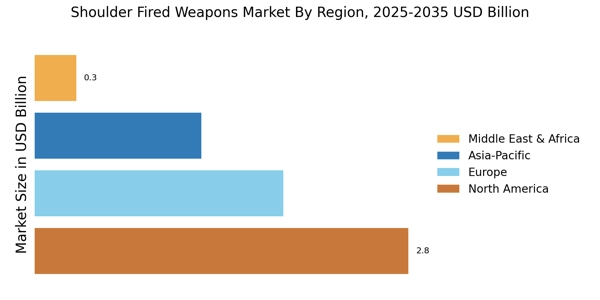

Figure 2: Shoulder-fired Weapons MARKET SHARE BY REGION 2022 (USD Billion)

Asia Pacific Shoulder-fired Weapons has several largest importers of weapons, such as China, India, South Korea, and Pakistan. India's and China's defense budgets have been increasing. It is expected that China has spent around USD 293 billion in military expenditure as of 2021, with India's, defense spending computed at a total of USD 76.6 billion. China is a significant developer of shoulder-fired weapons, as well as its investment in the development the smart sensor-based weapons-based weapons having the capability of differencing between friends, foes, and neutral targets, for reducing the accidental shooting of vehicle and civilian aircraft.

The country is investing heavily in the development of shoulder-fired weapons. In February 2022, China has done testing of QW-12 modern MANPADS for intercepting jet aircraft, helicopters as well as cruise missiles in a live fire test.

The MANAPAD can hit a particularly designed target aircraft. India, with its military conflicts with china, has also heavily invested in the improvement of its portable weapons inventory. For instance, in April 2022, the country induced new MANPADS into defense. A few of the Russian-built Igla-S system MANPADS were tested, as well a much larger order of these is anticipated in the coming year. The order includes 216 missiles, 24 launches as well as testing equipment. India is also investing majorly in the improvement of the existing anti-tank as well as anti-missile capabilities.

For example, in January 2022, the Indian Airforce and Indian Army partnered with Saab AB to obtain an AT4 single-shot shoulder-fired weapon via the competitive program.

The shoulder fired weapons market has witnessed high growth in recent years owing to the increasing defense expenditure, increasing need for portable anti-tank weapons, and increasing demand for lightweight guided weapons. However, the transfer of technology and restriction on the sale and traumatic brain injuries caused using shoulder fired weapons is expected to hinder the growth of the market to some extent. The market in this region is projected to expand at a high CAGR during the forecast period.

Increasing defense expenditure and rising terrorist activities in India, Indonesia, and Australia are driving the growth of the market in the region. Also, in July 2020, the Indian army announced the procurement of the Spike LR Anti-tank guided missiles from Israel. Further, the China Shoulder-fired Weapons market held the largest market share, and the India Shoulder-fired Weapons market was the fastest growing market in the region.

Europe Shoulder-fired Weapons market accounts for the second-largest market share Upgradation in artillery and armor has resulted in increasing demand for defense and military products, thereby driving revenues in the shoulder-fired weapon market. Increasing asymmetrical warfare, rising security requirements as well as protection against terrorist activities along with advancement in forces have been driving the growth of the shoulder-fired weapon market. Rising demand from the government for advancing weapons in the national armory system was further attributed to the growth of the shoulder-fired weapon market.

Although, the demand for the automated missile system and associated surface fighting equipment that lacks human interface (HI) is likely to pose threats to the growth of the shoulder-fired weapon market. The rising adoption of advanced weapons as well as significant growth in the military along with defense sectors represents a major factor boosting the demand for shoulder-fired weapons around the globe. The increasing instances of violence, terrorism, and armed conflicts are driving market growth.

Furthermore, the growth in the investment by the defense as well as military organizations in the upgradation of infrastructure for enhancing national security is supporting the growth of the market. Furthermore, there is a rise in demand for man-portable air defense systems that offer a massive advantage to military forces. Several players are developing smart shoulder-fired weapons embedded in electronic warfare systems for providing augmented reality information to operators.

They also integrate artificial intelligence, satellite guidance systems as well as machine learning which allow military personnel to deal with combatants in the war as well as minimize the collateral damage thus attributed to the market. Moreover, UK Shoulder-fired Weapons market held the largest market share, and the Germany Shoulder-fired Weapons market was the fastest-growing market in the region.