Increasing Healthcare Expenditure

The rise in healthcare expenditure across various regions is a significant driver of the Shoulder Replacement Market. As governments and private sectors allocate more resources to healthcare, there is a corresponding increase in funding for orthopedic procedures, including shoulder replacements. This trend is particularly evident in developed economies, where healthcare budgets are expanding to accommodate advanced surgical techniques and technologies. Moreover, the growing emphasis on improving patient outcomes and reducing long-term healthcare costs is likely to further bolster investments in shoulder replacement surgeries. Consequently, the Shoulder Replacement Market stands to benefit from this upward trajectory in healthcare spending.

Advancements in Surgical Techniques

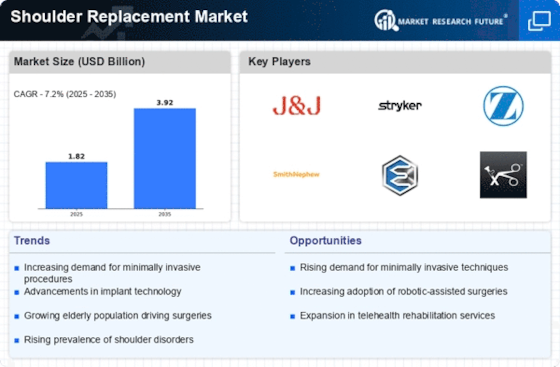

Innovations in surgical techniques, particularly minimally invasive approaches, are transforming the Shoulder Replacement Market. These advancements not only enhance patient outcomes but also reduce recovery times, making shoulder replacement surgeries more appealing to both patients and surgeons. For instance, the adoption of arthroscopic techniques has been shown to decrease postoperative pain and complications, thereby increasing patient satisfaction. As these techniques become more widely adopted, the market is likely to experience a surge in demand. Furthermore, the integration of robotic-assisted surgery is anticipated to further refine these procedures, potentially leading to improved precision and efficiency in shoulder replacements.

Rising Incidence of Shoulder Disorders

The increasing prevalence of shoulder disorders, such as rotator cuff tears and osteoarthritis, is a primary driver of the Shoulder Replacement Market. As populations age, the incidence of these conditions tends to rise, leading to a greater demand for shoulder replacement surgeries. According to recent data, approximately 7.5 million individuals in the United States alone suffer from shoulder-related issues, which necessitates surgical intervention. This trend is mirrored in various regions, where healthcare systems are adapting to accommodate the growing number of patients requiring shoulder replacements. Consequently, the Shoulder Replacement Market is poised for growth as healthcare providers seek to implement effective solutions for managing these disorders.

Technological Innovations in Implant Design

Technological advancements in implant design are driving the evolution of the Shoulder Replacement Market. The development of new materials and designs, such as patient-specific implants and improved fixation methods, enhances the longevity and effectiveness of shoulder replacements. Recent studies indicate that modern implants can significantly reduce the risk of complications and improve functional outcomes for patients. As manufacturers continue to innovate and refine their products, the market is expected to expand, catering to the diverse needs of patients. This trend underscores the importance of ongoing research and development in the Shoulder Replacement Market, as it seeks to provide optimal solutions for patients.

Growing Awareness and Acceptance of Joint Replacement

There is a notable increase in awareness and acceptance of joint replacement surgeries among patients, which is significantly influencing the Shoulder Replacement Market. Educational initiatives and outreach programs have played a crucial role in informing patients about the benefits of shoulder replacements, including improved quality of life and pain relief. As more individuals become informed about their treatment options, the demand for shoulder replacements is expected to rise. Additionally, the societal stigma surrounding joint surgeries is diminishing, leading to a more proactive approach to managing shoulder disorders. This cultural shift is likely to contribute to the sustained growth of the Shoulder Replacement Market.