Market Growth Projections

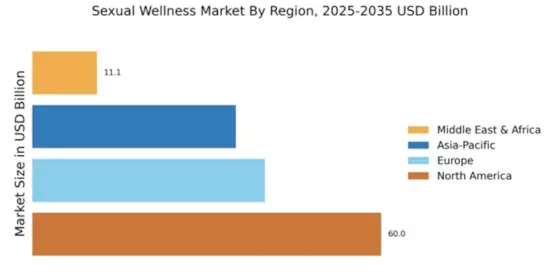

The Global Sexual Wellness Market Industry is on a promising growth trajectory, with projections indicating a market value of 40.9 USD Billion in 2024 and an anticipated increase to 81 USD Billion by 2035. This growth is underpinned by a compound annual growth rate of 6.41% from 2025 to 2035, suggesting a robust expansion driven by various factors, including increased awareness, evolving attitudes, and technological advancements. These figures illustrate the market's potential and the evolving landscape of sexual wellness.

Evolving Attitudes Towards Sexuality

Shifting societal norms and evolving attitudes towards sexuality significantly influence the Global Sexual Wellness Market Industry. As cultural taboos surrounding sexual wellness diminish, consumers are increasingly open to discussing and purchasing sexual wellness products. This change in perception is likely to contribute to market growth, as individuals seek products that enhance their sexual experiences. The market is expected to expand further, with projections indicating a value of 81 USD Billion by 2035, highlighting the potential for sustained growth driven by changing societal attitudes.

Rise of E-commerce and Online Retail

The Global Sexual Wellness Market Industry is witnessing a significant shift towards e-commerce and online retail platforms. The convenience and privacy offered by online shopping appeal to consumers, allowing them to explore and purchase sexual wellness products without societal judgment. This trend is likely to bolster market growth, as more individuals turn to online platforms for their sexual wellness needs. The increasing penetration of the internet and mobile devices further supports this shift, making it easier for consumers to access a diverse range of products.

Focus on Mental Health and Well-being

There is a growing recognition of the connection between sexual wellness and mental health, which is influencing the Global Sexual Wellness Market Industry. As individuals prioritize their overall well-being, products that promote sexual health are increasingly viewed as essential components of mental wellness. This trend is likely to drive demand for sexual wellness products that enhance intimacy and personal satisfaction. The market's growth trajectory reflects this shift, as consumers seek holistic approaches to health that encompass both physical and mental aspects.

Increasing Awareness of Sexual Health

The Global Sexual Wellness Market Industry experiences a notable surge in awareness surrounding sexual health and wellness. Educational initiatives and campaigns aimed at promoting sexual health are becoming more prevalent, leading to a more informed consumer base. This heightened awareness is likely to drive demand for various products, including contraceptives, lubricants, and sexual enhancement items. As individuals become more conscious of their sexual health, the market is projected to reach 40.9 USD Billion in 2024, reflecting a growing recognition of the importance of sexual wellness in overall health.

Technological Advancements in Product Development

Innovations in technology are reshaping the Global Sexual Wellness Market Industry, leading to the development of new and improved products. Advances in materials and design have resulted in a wider range of options for consumers, including smart devices and personalized products. These technological enhancements not only improve user experience but also attract a tech-savvy demographic. As a result, the market is poised for growth, with a projected compound annual growth rate of 6.41% from 2025 to 2035, indicating a strong trajectory fueled by ongoing innovation.