Rising Data Volume

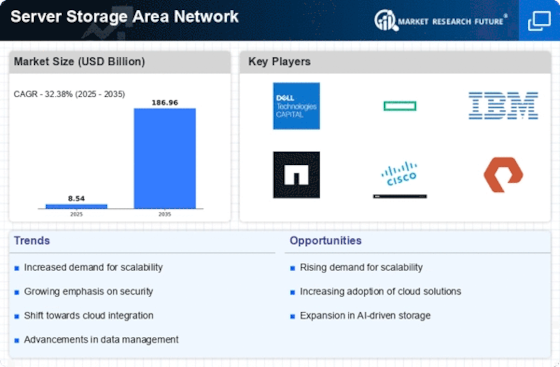

The exponential growth of data generated by businesses and consumers is a primary driver for the Server Storage Area Network Market. As organizations increasingly rely on data analytics and big data technologies, the demand for efficient storage solutions escalates. According to recent statistics, data creation is projected to reach 175 zettabytes by 2025, necessitating robust storage infrastructures. Server Storage Area Networks provide scalable and high-performance solutions that can accommodate this burgeoning data volume. This trend is particularly evident in sectors such as healthcare, finance, and e-commerce, where data-driven decision-making is paramount. Consequently, the Server Storage Area Network Industry is likely to experience significant growth as enterprises seek to enhance their storage capabilities to manage and analyze vast amounts of data.

Increased Focus on Data Security

In an era where data breaches and cyber threats are prevalent, the emphasis on data security is a significant driver for the Server Storage Area Network Market. Organizations are compelled to invest in secure storage solutions to protect sensitive information and comply with regulatory requirements. The global cost of data breaches is projected to reach 5 trillion dollars by 2025, underscoring the urgency for robust security measures. Server Storage Area Networks offer advanced security features, including encryption, access controls, and data redundancy, which are essential for safeguarding data integrity. As businesses prioritize data protection, the demand for secure storage solutions within the Server Storage Area Network Industry is expected to rise, leading to increased investments in security technologies and practices.

Growing Demand for Virtualization

The increasing adoption of virtualization technologies is a key driver for the Server Storage Area Network Market. Virtualization allows organizations to maximize their hardware resources by running multiple virtual machines on a single physical server. This trend is particularly prevalent in data centers, where efficient resource utilization is critical. According to industry forecasts, the virtualization market is expected to grow at a CAGR of 10% through 2025. Server Storage Area Networks are integral to this environment, providing the necessary storage capacity and performance to support virtualized workloads. As businesses continue to embrace virtualization for its cost-saving and efficiency benefits, the Server Storage Area Network Industry is likely to see sustained growth, driven by the need for reliable and high-performance storage solutions.

Emergence of Hybrid IT Environments

The transition towards hybrid IT environments, which combine on-premises infrastructure with cloud services, is reshaping the Server Storage Area Network Market. Organizations are increasingly adopting hybrid models to leverage the benefits of both local and cloud storage solutions. This shift is driven by the need for flexibility, scalability, and cost-effectiveness. As per industry reports, approximately 70% of enterprises are expected to implement hybrid cloud strategies by 2025. Server Storage Area Networks play a crucial role in this ecosystem by providing seamless integration between on-premises storage and cloud resources. This integration allows businesses to optimize their storage resources, ensuring that critical data is readily accessible while also benefiting from the scalability of cloud solutions. Thus, the Server Storage Area Network Industry is poised for growth as companies navigate the complexities of hybrid IT.

Advancements in Storage Technologies

Technological advancements in storage solutions are driving innovation within the Server Storage Area Network Market. Emerging technologies such as NVMe (Non-Volatile Memory Express) and SSD (Solid State Drive) are enhancing storage performance and efficiency. These advancements enable faster data access and improved I/O operations, which are critical for modern applications and workloads. The adoption of these technologies is anticipated to grow, with SSDs expected to account for over 50% of the storage market by 2025. As organizations seek to optimize their storage infrastructures, the Server Storage Area Network Industry is likely to benefit from the integration of these cutting-edge technologies, leading to enhanced performance and reduced latency in data processing.