Rising Demand for Data Storage Solutions

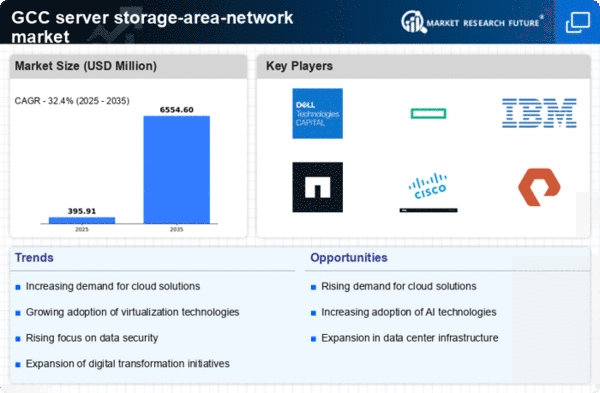

The server storage-area-network market experiences a notable surge in demand for data storage solutions across various sectors in the GCC. As organizations increasingly rely on data-driven decision-making, the need for efficient and scalable storage systems becomes paramount. The market is projected to grow at a CAGR of approximately 15% from 2025 to 2030, driven by the expansion of digital services and the proliferation of IoT devices. This growth indicates a shift towards more robust storage infrastructures, as businesses seek to manage vast amounts of data effectively. Consequently, The server storage-area-network market is positioned to benefit from this trend. Companies are investing in advanced storage technologies to enhance their operational capabilities.

Increased Investment in IT Infrastructure

In the GCC, increased investment in IT infrastructure is a pivotal driver for the server storage-area-network market. Governments and private sectors are channeling substantial resources into enhancing their technological capabilities, recognizing the importance of robust IT systems for economic growth. This investment trend is reflected in various initiatives aimed at digital transformation, which often include upgrading storage solutions. As organizations seek to modernize their IT infrastructure, the server storage-area-network market stands to gain from this influx of capital. The anticipated growth in IT spending, projected to reach $20 billion by 2026, underscores the potential for expansion within the server storage-area-network market, as businesses prioritize efficient and scalable storage solutions.

Expansion of E-commerce and Digital Services

The expansion of e-commerce and digital services in the GCC is a significant driver for the server storage-area-network market. As online retail and digital platforms continue to proliferate, the demand for reliable and scalable storage solutions intensifies. E-commerce businesses require efficient data management systems to handle transactions, customer data, and inventory information. This surge in digital activity is expected to propel the server storage-area-network market, with projections indicating a potential market size increase of over $1 billion by 2030. The need for high-performance storage solutions that can support rapid data access and processing is critical for e-commerce success, thereby driving investments in the server storage-area-network market.

Growing Focus on Data Compliance and Governance

In the GCC, the growing focus on data compliance and governance significantly impacts the server storage-area-network market. With the implementation of stringent regulations such as the GDPR and local data protection laws, organizations are compelled to adopt storage solutions that ensure data integrity and security. This regulatory landscape drives the demand for storage systems that offer robust compliance features, including encryption and access controls. As businesses prioritize data governance, The server storage-area-network market is likely to see increased investments in compliant storage solutions. This trend enhances data security and fosters trust among customers. This trend not only enhances data security but also fosters trust among customers, ultimately contributing to the market's growth in the region.

Technological Advancements in Storage Solutions

Technological advancements play a crucial role in shaping the server storage-area-network market. Innovations such as NVMe over Fabrics and software-defined storage are revolutionizing how data is stored and accessed. These technologies enhance performance, reduce latency, and improve overall efficiency, making them attractive to organizations in the GCC. The integration of AI and machine learning into storage solutions further optimizes data management processes, allowing for predictive analytics and automated workflows. As a result, businesses are increasingly adopting these advanced technologies, which is likely to drive growth in the server storage-area-network market. The ongoing evolution of storage technologies suggests a promising future for the industry, as companies strive to stay competitive in a rapidly changing digital landscape.