Growth in Data Center Infrastructure

The expansion of data center infrastructure is a crucial driver for the SerDes Market. As organizations increasingly rely on cloud computing and big data analytics, the demand for efficient data processing and storage solutions is rising. Reports suggest that the data center market is expected to grow at a compound annual growth rate of over 10% through 2025. This growth necessitates advanced SerDes Market technologies that can facilitate high-speed communication between servers and storage devices. Consequently, the SerDes Market is witnessing a surge in demand for products that enhance data transfer rates and reduce latency, thereby improving overall data center performance. Companies are likely to prioritize the development of SerDes Market solutions that align with these trends, ensuring they remain competitive in a rapidly evolving market.

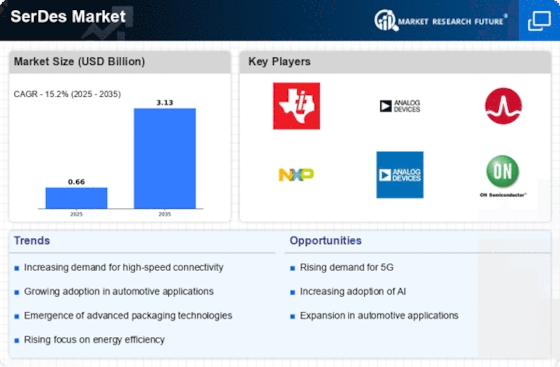

Increasing Adoption of 5G Technology

The ongoing rollout of 5G technology is driving the SerDes Market as it necessitates high-speed data transmission and low latency. With 5G networks becoming more prevalent, the demand for SerDes Market solutions that can support these requirements is likely to surge. According to recent estimates, the number of 5G connections is projected to reach over 1 billion by 2025, which could significantly impact the SerDes Market. This trend indicates that manufacturers are focusing on developing SerDes Market products that can handle the increased data rates and bandwidth associated with 5G applications. As a result, companies are investing in research and development to create innovative SerDes Market solutions that meet the evolving needs of telecommunications and data centers.

Advancements in Automotive Electronics

The automotive sector is undergoing a transformation with the rise of electric vehicles (EVs) and advanced driver-assistance systems (ADAS). This shift is significantly impacting the SerDes Market, as these technologies require robust data communication solutions. The automotive electronics market is projected to grow at a rate of approximately 8% annually, driven by the increasing complexity of vehicle systems. As vehicles become more connected and automated, the demand for high-speed SerDes Market solutions that can facilitate communication between various electronic components is likely to increase. Manufacturers are expected to invest in developing SerDes Market technologies that meet the stringent requirements of automotive applications, thereby positioning themselves favorably within the SerDes Market.

Rising Demand for High-Performance Computing

The demand for high-performance computing (HPC) is on the rise, driven by the need for advanced computational capabilities in various industries, including scientific research, finance, and engineering. This trend is significantly influencing the SerDes Market, as HPC systems require efficient data transfer solutions to handle large volumes of data. The HPC market is anticipated to grow at a compound annual growth rate of around 7% through 2025, which could lead to increased investments in SerDes Market technologies. As organizations seek to enhance their computational power, the need for high-speed SerDes Market solutions that can support these systems is likely to grow. This suggests that the SerDes Market may see a surge in demand for products designed specifically for HPC applications, thereby driving innovation and competition.

Emergence of Artificial Intelligence and Machine Learning

The increasing integration of artificial intelligence (AI) and machine learning (ML) technologies is influencing the SerDes Market. These technologies require substantial data processing capabilities, which in turn necessitate high-performance SerDes Market solutions. As AI and ML applications proliferate across various sectors, including automotive, healthcare, and finance, the demand for SerDes Market products that can support these applications is expected to rise. Analysts predict that the AI market will reach a valuation of over 500 billion by 2025, further driving the need for efficient data communication solutions. This trend suggests that manufacturers in the SerDes Market may focus on developing specialized products that cater to the unique requirements of AI and ML applications, thereby enhancing their market position.