Rising Incidence of Sepsis

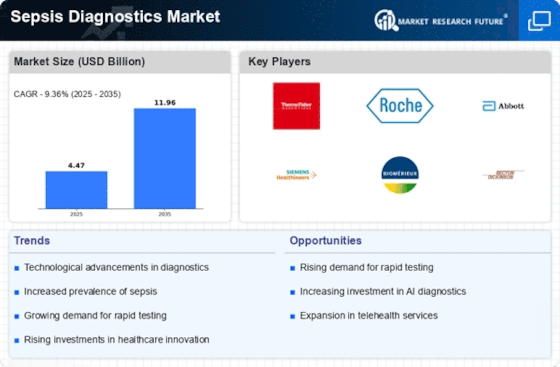

The increasing incidence of sepsis is a primary driver for the Sepsis Diagnostics Market. According to estimates, sepsis affects millions of individuals annually, leading to significant morbidity and mortality. This rising prevalence necessitates the development and implementation of effective diagnostic tools to facilitate early detection and treatment. As healthcare systems strive to improve patient outcomes, the demand for innovative diagnostic solutions is likely to surge. The World Health Organization has highlighted the need for enhanced sepsis management, further propelling investments in diagnostic technologies. Consequently, the Sepsis Diagnostics Market is expected to witness substantial growth as healthcare providers seek to adopt advanced diagnostic methods to combat this life-threatening condition.

Growing Awareness and Education

Growing awareness and education regarding sepsis are pivotal in driving the Sepsis Diagnostics Market. Healthcare professionals and the general public are becoming more informed about the signs and symptoms of sepsis, leading to earlier recognition and treatment. Campaigns aimed at educating both healthcare providers and patients about sepsis have gained momentum, resulting in increased demand for diagnostic solutions. This heightened awareness is likely to translate into a greater emphasis on early diagnosis, thereby boosting the market for sepsis diagnostics. Furthermore, educational initiatives by health organizations are expected to foster collaboration among stakeholders, ultimately enhancing the overall landscape of the Sepsis Diagnostics Market.

Increased Healthcare Expenditure

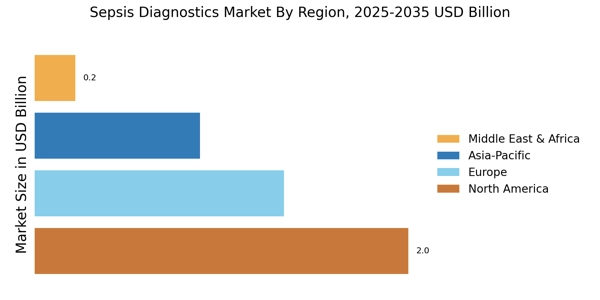

Increased healthcare expenditure is a significant driver of the Sepsis Diagnostics Market. As countries allocate more resources to healthcare, there is a corresponding rise in investments in diagnostic technologies. This trend is particularly evident in regions where healthcare budgets are expanding to improve patient outcomes. The emphasis on value-based care has prompted healthcare providers to seek effective diagnostic solutions that can reduce hospital stays and associated costs. Consequently, the demand for sepsis diagnostics is likely to grow as healthcare systems prioritize early detection and intervention. The Sepsis Diagnostics Market stands to benefit from this trend, as stakeholders recognize the importance of investing in advanced diagnostic tools to enhance patient care.

Regulatory Support for Diagnostic Innovations

Regulatory support for diagnostic innovations is a key driver of the Sepsis Diagnostics Market. Regulatory bodies are increasingly recognizing the importance of rapid and accurate diagnostics in managing sepsis. Initiatives aimed at expediting the approval process for new diagnostic technologies are fostering innovation within the market. This supportive regulatory environment encourages companies to invest in research and development, leading to the introduction of novel diagnostic solutions. As a result, the Sepsis Diagnostics Market is likely to experience growth as new products enter the market, enhancing the ability of healthcare providers to diagnose and treat sepsis effectively.

Technological Innovations in Diagnostic Tools

Technological innovations play a crucial role in shaping the Sepsis Diagnostics Market. The advent of advanced diagnostic technologies, such as molecular diagnostics and point-of-care testing, has revolutionized the way sepsis is diagnosed. These innovations enable rapid and accurate identification of pathogens, which is essential for timely treatment. For instance, the integration of artificial intelligence and machine learning in diagnostic tools enhances the accuracy of sepsis detection. As a result, healthcare providers are increasingly adopting these technologies to improve patient care. The market for sepsis diagnostics is projected to expand significantly, driven by the continuous evolution of diagnostic technologies that enhance the speed and reliability of sepsis detection.