Market Growth Projections

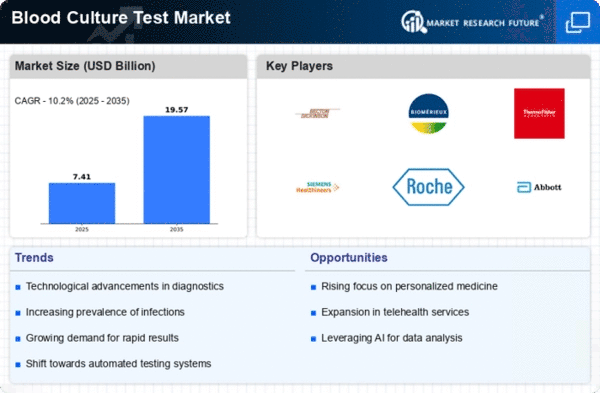

The Global Blood Culture Test Market Industry is projected to experience substantial growth over the next decade. With a compound annual growth rate (CAGR) of 10.21% anticipated from 2025 to 2035, the market is expected to evolve significantly. By 2035, the market could reach 19.6 USD Billion, reflecting the increasing demand for effective diagnostic solutions. This growth is driven by various factors, including technological advancements, rising healthcare expenditures, and the need for early diagnosis of infectious diseases. The market's trajectory indicates a robust future, with ongoing innovations likely to enhance testing capabilities.

Increase in Healthcare Expenditure

The Global Blood Culture Test Market Industry is benefiting from the increase in healthcare expenditure across various regions. Governments and private sectors are investing more in healthcare infrastructure, which includes diagnostic laboratories and testing facilities. This investment is crucial for enhancing the availability and accessibility of blood culture tests. For example, countries with rising healthcare budgets are expanding their laboratory capabilities, leading to improved diagnostic services. This trend is likely to support the market's growth, as increased funding translates to better resources for conducting blood culture tests, ultimately improving patient care.

Growing Awareness of Early Diagnosis

There is a growing awareness regarding the importance of early diagnosis in managing infectious diseases, which is influencing the Global Blood Culture Test Market Industry. Healthcare professionals and patients alike are recognizing that timely detection can significantly improve treatment outcomes. Educational campaigns and guidelines from health authorities emphasize the need for prompt testing in suspected cases of infection. This heightened awareness is likely to lead to increased testing rates, thereby expanding the market. As healthcare systems prioritize early intervention, the demand for blood culture tests is expected to rise, contributing to a robust market growth.

Rising Incidence of Infectious Diseases

The Global Blood Culture Test Market Industry is experiencing growth due to the increasing prevalence of infectious diseases. Conditions such as sepsis, pneumonia, and bloodstream infections are on the rise, necessitating effective diagnostic solutions. According to health organizations, sepsis alone affects millions globally each year, leading to significant morbidity and mortality. This surge in infectious diseases drives demand for blood culture tests, which are essential for accurate diagnosis and timely treatment. As a result, the market is projected to reach 6.72 USD Billion in 2024, reflecting the urgent need for reliable diagnostic tools in clinical settings.

Technological Advancements in Diagnostic Tools

Advancements in technology are propelling the Global Blood Culture Test Market Industry forward. Innovations such as automated blood culture systems and molecular diagnostics enhance the speed and accuracy of test results. These technologies reduce the time to detection of pathogens, which is crucial for effective patient management. For instance, newer systems can provide results within hours, compared to traditional methods that may take days. This efficiency is likely to attract healthcare facilities seeking to improve patient outcomes. The market's growth trajectory suggests a potential increase to 19.6 USD Billion by 2035, driven by these technological enhancements.

Emerging Markets and Expanding Healthcare Access

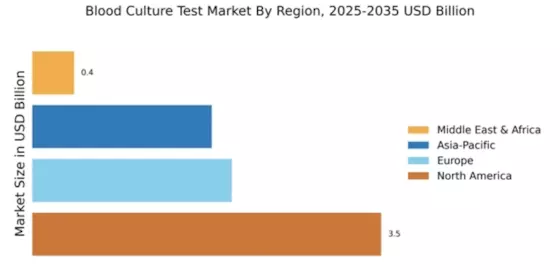

Emerging markets are playing a pivotal role in the Global Blood Culture Test Market Industry. As countries in Asia, Africa, and Latin America develop their healthcare systems, access to diagnostic testing is expanding. This growth is fueled by investments in healthcare infrastructure and initiatives aimed at improving disease management. For instance, governments are implementing programs to enhance laboratory services, which include blood culture testing. The increasing population and rising incidence of infectious diseases in these regions suggest a growing demand for blood culture tests, contributing to the overall market expansion.