Global Population Growth and Food Demand

The Global Seed Treatment Market Industry is directly impacted by the increasing global population and the corresponding demand for food. As the world population continues to rise, the pressure on agricultural systems to produce more food becomes more pronounced. Seed treatments are essential in maximizing crop yields and ensuring food security. With projections indicating a population of nearly 9.7 billion by 2050, the need for efficient agricultural practices, including seed treatment, is more critical than ever. This demand is expected to drive the market towards substantial growth in the coming years.

Increasing Demand for High-Quality Seeds

The Global Seed Treatment Market Industry experiences a notable surge in demand for high-quality seeds, driven by the need for enhanced crop yields and improved resistance to pests and diseases. Farmers are increasingly adopting seed treatment technologies to ensure better germination rates and robust plant growth. This trend is particularly evident in regions with intensive agricultural practices, where the focus on quality is paramount. The market is projected to reach 6.47 USD Billion in 2024, reflecting the growing recognition of seed treatment as a vital component in achieving agricultural sustainability and productivity.

Government Support and Regulatory Frameworks

Government initiatives and supportive regulatory frameworks significantly influence the Global Seed Treatment Market Industry. Many countries are implementing policies that encourage the adoption of seed treatment technologies to enhance food security and agricultural productivity. Financial incentives, research funding, and educational programs aimed at farmers are becoming more prevalent. This support not only fosters innovation but also facilitates the widespread adoption of effective seed treatments. As a result, the market is poised for growth, with an anticipated increase in investment and development in seed treatment solutions.

Technological Advancements in Seed Treatment

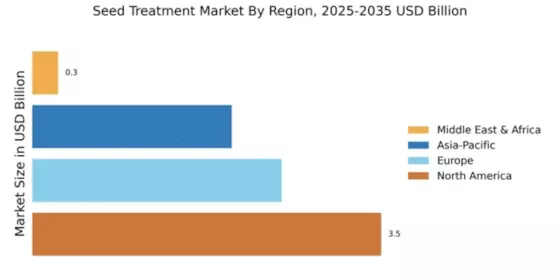

Technological innovations play a crucial role in shaping the Global Seed Treatment Market Industry. The introduction of advanced seed treatment formulations, such as biological and chemical agents, enhances the effectiveness of pest and disease control. Moreover, precision agriculture technologies facilitate targeted applications, optimizing resource use and minimizing environmental impact. As farmers increasingly seek efficient solutions, the market is expected to expand significantly, with projections indicating a growth to 14.2 USD Billion by 2035. This evolution in technology not only improves crop performance but also aligns with global sustainability goals.

Rising Awareness of Sustainable Agriculture Practices

The Global Seed Treatment Market Industry is witnessing a paradigm shift towards sustainable agricultural practices. Farmers are becoming more aware of the environmental implications of traditional farming methods and are increasingly adopting seed treatments that promote sustainability. These treatments often involve the use of biological agents and eco-friendly chemicals, which contribute to soil health and biodiversity. As a result, the market is likely to experience a compound annual growth rate (CAGR) of 7.41% from 2025 to 2035, reflecting the growing preference for sustainable solutions that align with global environmental standards.