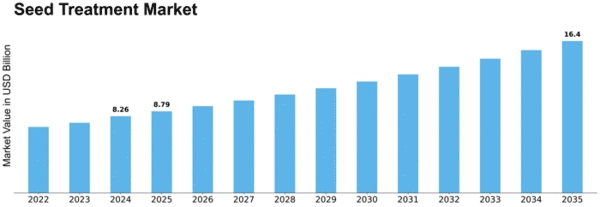

Seed Treatment Size

Seed Treatment Market Growth Projections and Opportunities

The seed treatment business has changed significantly in recent years due to agriculture's shifting terrain and concentration on crop yields. This method protects seeds from pests, improves germination, and boosts crop yield. Several elements that solve modern agriculture's difficulties affect seed treatment market dynamics.

Growing worldwide population and food need boost the seed treatment industry. Farmers want to optimize seed output with limited arable land and resources.

Seed treatment market dynamics have also been shaped by environmental concerns and sustainable agriculture. Traditional pest and disease management uses a lot of chemicals, which can harm the environment. Seed treatment is targeted and localized, lowering pesticide usage and agriculture's environmental impact. Seed treatment becomes an ecologically friendly agricultural solution as the sector prioritizes sustainability.

Technology in seed treatment products has boosted industry expansion. Manufacturers are developing new seed protection and performance formulas. Microbial agents and biopesticides are also part of the industry's commitment to sustainable and eco-friendly seed treatment options. These improvements increase seed treatment efficacy and handle agricultural product chemical residual problems.

Key companies in the seed treatment market provide a variety of products. These products are designed for certain crops, climates, and soils. Customized seed treatment methods are becoming more popular, allowing farmers to choose treatments depending on their needs. This versatility makes seed treatment practises more adaptable across agricultural situations.

However, regulatory issues, seed treatment chemical safety concerns, and farmer education and awareness remain. Due to transportation restrictions, the worldwide seed treatment industry saw little influence on seed care demand. Agriculture was undisturbed by lockdowns or government outages. Agrochemical businesses' earnings increased by double-digits due to farmers' increased purchase behavior in reaction to uncertainty. Companies guaranteed sufficient supply, allowing farmers to buy important seed treatment goods during this difficult time."

Leave a Comment