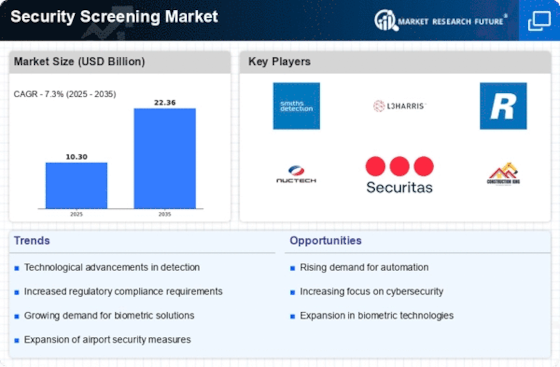

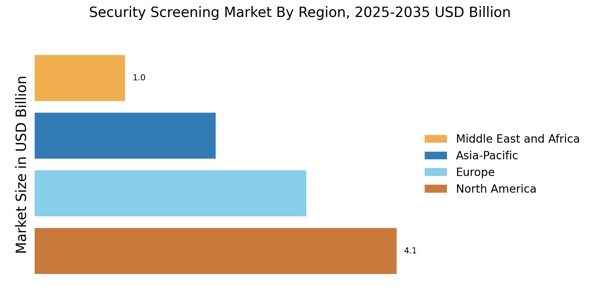

North America : Security Innovation Leader

North America is the largest market for security screening, holding approximately 40% of the global share, driven by increasing security threats and stringent regulations. The demand for advanced screening technologies is propelled by government initiatives and investments in infrastructure. The U.S. and Canada are the primary contributors, with a focus on enhancing airport security and public safety measures. Regulatory frameworks are evolving to incorporate advanced technologies, ensuring compliance and safety. The competitive landscape is dominated by key players such as L3Harris Technologies, Rapiscan Systems, and Smiths Detection. These companies are at the forefront of innovation, offering cutting-edge solutions tailored to meet the growing security demands. The presence of established firms fosters a robust ecosystem, encouraging collaboration and technological advancements. As security concerns escalate, the Security Screening Market is expected to witness sustained growth, with ongoing investments in research and development.

Europe : Regulatory Compliance Focus

Europe is the second-largest market for security screening, accounting for approximately 30% of the global market share. The region's growth is driven by increasing regulatory requirements and heightened security measures in public spaces, transportation, and critical infrastructure. Countries like the UK, Germany, and France are leading the charge, implementing stringent regulations to enhance safety and security protocols. The European Union's focus on harmonizing security standards further propels market growth, ensuring compliance across member states. The competitive landscape features prominent players such as Securitas AB and Cognitec Systems, which are leveraging advanced technologies to meet evolving security needs. The presence of innovative firms fosters a dynamic market environment, encouraging the development of state-of-the-art screening solutions. As security threats continue to evolve, the demand for effective screening technologies is expected to rise, driving further investments in the sector.

Asia-Pacific : Emerging Market Potential

Asia-Pacific is witnessing significant growth in the security screening market, holding approximately 20% of the global share. The region's expansion is fueled by increasing urbanization, rising security concerns, and government initiatives aimed at enhancing public safety. Countries like China, India, and Japan are at the forefront, investing heavily in advanced screening technologies to address security challenges in transportation and public venues. Regulatory frameworks are evolving to support the adoption of innovative solutions, driving market demand. The competitive landscape is characterized by the presence of key players such as Nuctech Company Limited and AS&E, which are actively developing cutting-edge technologies tailored to regional needs. The Security Screening Market is becoming increasingly competitive, with local and international firms vying for market share. As security threats become more sophisticated, the demand for advanced screening solutions is expected to surge, prompting further investments in research and development.

Middle East and Africa : Security Enhancement Initiatives

The Middle East and Africa region is emerging as a significant player in the security screening market, accounting for approximately 10% of the global share. The growth is driven by increasing security threats, geopolitical tensions, and government initiatives aimed at enhancing public safety. Countries like the UAE and South Africa are leading the way, investing in advanced screening technologies to secure airports, borders, and public spaces. Regulatory frameworks are being established to support the adoption of innovative security solutions, fostering market growth. The competitive landscape features a mix of local and international players, with companies like Teledyne Technologies and Kromek Group making strides in the region. The presence of diverse firms encourages innovation and collaboration, driving the development of tailored screening solutions. As security concerns escalate, the demand for effective screening technologies is expected to rise, prompting further investments in the sector.