Rising Cybersecurity Threats

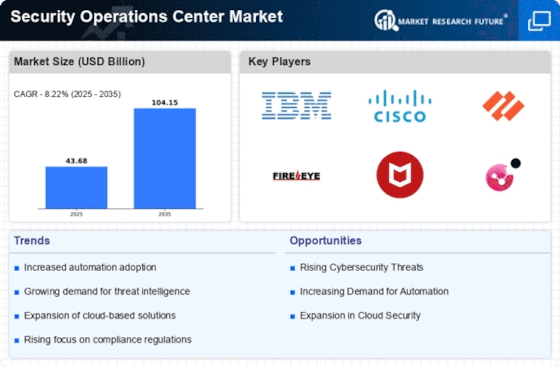

The increasing frequency and sophistication of cyber threats is a primary driver for the Security Operations Center Market. Organizations are facing a myriad of attacks, including ransomware, phishing, and advanced persistent threats. According to recent data, cybercrime is projected to cost businesses trillions annually, prompting a surge in demand for robust security solutions. As a result, companies are investing heavily in Security Operations Centers to enhance their threat detection and response capabilities. This trend indicates a growing recognition of the necessity for proactive security measures, thereby fueling the expansion of the Security Operations Center Market.

Regulatory Compliance Pressures

The evolving landscape of regulatory requirements is significantly influencing the Security Operations Center Market. Organizations are increasingly required to comply with stringent regulations such as GDPR, HIPAA, and PCI DSS. Non-compliance can lead to severe penalties and reputational damage, which drives companies to establish or enhance their Security Operations Centers. The need for continuous monitoring and reporting to meet compliance standards is creating a robust demand for SOC solutions. This trend suggests that as regulations become more complex, the Security Operations Center Market will likely experience sustained growth as organizations seek to mitigate compliance risks.

Adoption of Cloud-Based Solutions

The shift towards cloud computing is reshaping the Security Operations Center Market. As businesses migrate their operations to the cloud, the need for cloud-native security solutions becomes paramount. Security Operations Centers are adapting to provide services that cater to cloud environments, ensuring that data remains secure across various platforms. Market data indicates that the cloud security market is expected to grow significantly, which in turn is likely to bolster the Security Operations Center Market. This transition suggests that organizations are increasingly recognizing the importance of integrating security measures within their cloud strategies.

Increased Investment in Cybersecurity

Organizations are allocating larger budgets towards cybersecurity initiatives, which is a crucial driver for the Security Operations Center Market. The recognition of cybersecurity as a critical business function has led to increased funding for SOCs. Recent statistics reveal that cybersecurity spending is expected to reach substantial figures in the coming years, reflecting a heightened awareness of the risks associated with cyber threats. This trend indicates that as organizations prioritize cybersecurity, the demand for advanced Security Operations Center solutions will likely continue to rise, further propelling the market forward.

Emergence of Artificial Intelligence and Automation

The integration of artificial intelligence and automation technologies is transforming the Security Operations Center Market. These technologies enhance the efficiency and effectiveness of threat detection and incident response. By automating routine tasks, Security Operations Centers can focus on more complex security challenges. The market is witnessing a growing trend towards AI-driven analytics, which can significantly reduce response times and improve overall security posture. This evolution suggests that as organizations seek to leverage technology for better security outcomes, the Security Operations Center Market will likely see substantial advancements and growth.