Market Analysis

In-depth Analysis of Second Generation Bio fuels Market Industry Landscape

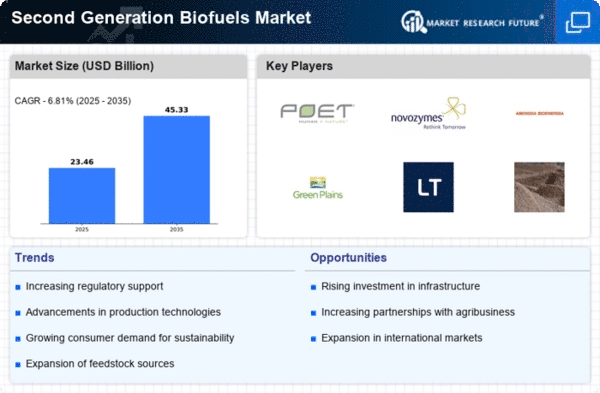

Second-generation biofuels are undergoing a major market change due to increased demand for affordable, environmentally friendly power. Horticultural waste, wood, and green growth are used to make second-generation biofuels like bioethanol and biodiesel. Due to their lack of food production and ability to use waste, these biofuels are safer for the environment than their predecessors. The growing global awareness of the need to reduce ozone-depleting substances and fight environmental change is driving the market. Second-generation biofuels are a viable option for legislatures and corporations seeking cleaner energy.

Technology and research have improved production cycles and cost efficiencies, affecting market factors. Advances in protein invention and maturation have made biomass-to-biofuel conversion more profitable. This mechanical improvement has attracted investors and companies, boosting corporate growth and flexibility. The administrative scene is also improving to support second-generation biofuels. States are encouraging the production and use of high-level biofuels, creating a large market for industry players.

Another factor is the availability of second-generation biofuel feedstocks, which keeps the market dynamic. Using maize stover, wheat straw, switchgrass, and miscanthus reduces feedstock dependence and increases adaptability. This variety ensures a more stable and flexible manufacturing network, reducing value change and accessibility risks. The market is seeing biofuel makers and horticultural partners collaborate more on feedstock sourcing and storage.

Despite progress, second-generation biofuels face market obstacles. Some investors are frustrated by the capital costs of biofuel creation offices. However, innovation and economies of scale should reduce these costs, making second-generation biofuels more competitive. The competition with regular petroleum derivatives, which dominate the energy market, is crucial. Market entry includes overcoming framework constraints and meeting customer perceptions of biofuels' presentation and compatibility with existing transportation frameworks.

Leave a Comment