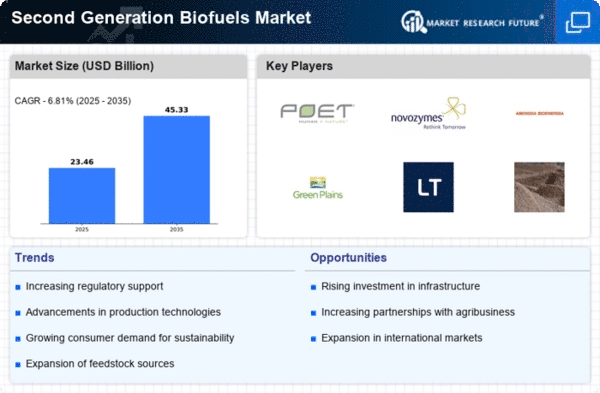

Top Industry Leaders in the Second Generation Bio fuels Market

The global second-generation biofuels market, fueled by rising fossil fuel costs, climate change concerns, and government sustainability mandates, is poised for significant growth. Unlike first-generation fuels derived from food crops, these biofuels utilize non-food biomass like woody crops, agricultural residues, and algae, minimizing competition with food production and land use.

Strategies Shaping the Landscape:

-

Technology-Driven Optimization: Companies are focusing on R&D to enhance feedstock utilization, conversion processes, and yields. Clariant's Sunliquid® technology and POET's cellulosic ethanol plants exemplify this trend. -

Feedstock Diversification: Expanding beyond traditional feedstock like corn stover, companies are exploring algae (Neste Oy), energy crops (Miscanthus, Stora Enso), and even municipal solid waste (Bioenergy DevCo) to optimize cost and sustainability. -

Strategic Partnerships: Collaborations between established players and startups are accelerating innovation. BP partnered with LanzaTech for sustainable jet fuel production, while Chevron Phillips Chemical Company invested in Gevo for renewable fuels. -

Government Support: Policy frameworks supporting biofuel mandates, tax incentives, and carbon credits, like the US Renewable Fuel Standard, incentivize investments and market growth. -

Regional Focus: Market leaders are tailoring strategies to regional demands. In Asia, companies like ENN Energy focus on biodiesel from waste cooking oil, while Europe emphasizes advanced biofuels like HVO (Neste Oy, UPM).

Factors for Market Share:

-

Cost Competitiveness: Achieving cost parity with fossil fuels remains a primary hurdle. Companies like Virent and Gevo strive for cost-effective production through process enhancements and scale-up. -

Technological Efficiency: Optimizing conversion processes for higher yields and lower energy consumption is crucial for profitability. Companies like LanzaTech and AltEnergy are spearheading advancements in biogas upgrading and biocrude production. -

Feedstock Security: Reliable and sustainable access to diverse feedstock is vital. Established players like Raizen invest in feedstock cultivation programs, while others pursue partnerships with local biomass providers. -

Regulatory Landscape: Favorable government policies like carbon pricing and blending mandates directly impact market growth. Companies actively engage with policymakers to advocate for supportive regulations. -

Public Perception: Building consumer trust and awareness about the sustainability benefits of second-generation biofuels is crucial for market acceptance. Companies actively invest in communication campaigns and partnerships with environmental organizations.

Key Companies in the Second Generation Bio-fuels market

- ALGENOL BIOFUELS

- Fiberight

- GranBio

- Poet LLC

- Clariant AG

- INEOS Group, Ltd

- Reliance Industries Limited

Recent Developments

-

July 2023: Lanzatech partners with Chevron to scale up production of sustainable jet fuel from waste gases, marking a significant step towards decarbonizing aviation. -

August 2023: Neste Oy unveils plans for a new HVO plant in Singapore, expanding its production capacity to meet growing regional demand. -

September 2023: Clariant secures funding for a Sunliquid® cellulosic ethanol plant in Romania, demonstrating increasing investor confidence in the technology. -

October 2023: POET announces construction of a new cellulosic ethanol plant in Iowa, showcasing continued growth in the US biofuels market.