Growing Focus on Safety Standards

Safety remains a paramount concern in the aviation industry, influencing the avionics data-loaders market in Russia. The increasing emphasis on compliance with international safety standards necessitates the adoption of advanced data-loading solutions. As regulatory bodies enforce stricter guidelines, operators are compelled to upgrade their systems to meet these requirements. This trend is likely to drive the demand for avionics data-loaders, as they play a crucial role in ensuring that aircraft systems are updated with the latest safety protocols. The market is projected to grow at a CAGR of XX% over the next five years, reflecting the industry's commitment to enhancing safety through technological advancements.

Increased Demand for Modernization

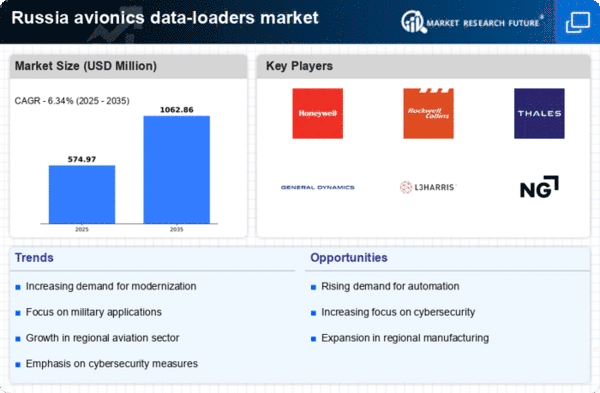

The avionics data-loaders market in Russia is experiencing a surge in demand driven by the modernization of aging aircraft fleets. As the aviation sector seeks to enhance operational efficiency and safety, there is a notable shift towards integrating advanced avionics systems. This modernization trend is expected to propel the avionics data-loaders market, as these systems require sophisticated data-loading solutions to ensure seamless updates and functionality. The Russian government has also initiated various programs aimed at upgrading its aviation infrastructure, which could further stimulate market growth. With an estimated market value of $XX million in 2025, the avionics data-loaders market is poised for significant expansion as airlines and operators invest in next-generation technologies.

Expansion of Domestic Aviation Sector

The expansion of the domestic aviation sector in Russia is a significant driver for the avionics data-loaders market. With an increase in air travel demand, airlines are investing in new aircraft and upgrading existing fleets. This growth is accompanied by a need for efficient data management systems, which are essential for maintaining and updating avionics systems. The Russian aviation market is expected to reach a valuation of $XX billion by 2025, creating a substantial opportunity for avionics data-loaders. As airlines seek to optimize their operations, the demand for reliable data-loading solutions is likely to rise, further propelling market growth.

Technological Integration in Aviation

The integration of cutting-edge technologies in the aviation sector is reshaping the avionics data-loaders market. Innovations such as artificial intelligence, machine learning, and cloud computing are being increasingly adopted to enhance data processing capabilities. These technologies enable more efficient data management and real-time updates, which are critical for modern avionics systems. As Russian airlines and manufacturers embrace these advancements, the demand for sophisticated avionics data-loaders is expected to increase. The market is anticipated to witness a growth rate of XX% as stakeholders recognize the value of integrating technology into their operations.

Investment in Research and Development

Investment in research and development (R&D) within the aviation sector is a key driver for the avionics data-loaders market. Russian companies are allocating substantial resources to innovate and develop advanced data-loading solutions that meet the evolving needs of the industry. This focus on R&D is likely to result in the introduction of more efficient and reliable avionics data-loaders, which can handle complex data requirements. As the market becomes increasingly competitive, companies that prioritize R&D are expected to gain a significant advantage. The avionics data-loaders market could see a growth trajectory influenced by these investments, potentially reaching $XX million by 2025.