Expansion of Commercial Aviation Sector

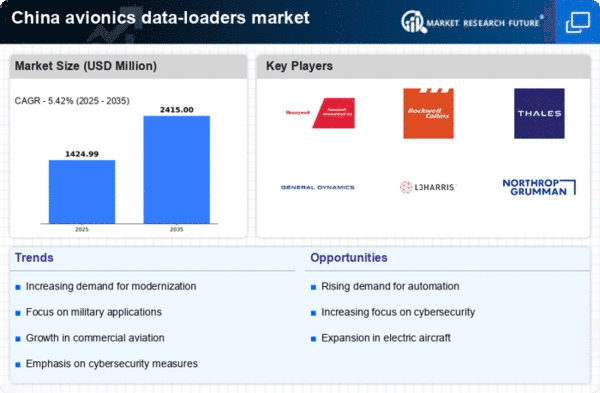

The commercial aviation sector in China is witnessing rapid expansion, fueled by increasing passenger traffic and the rise of low-cost carriers. This growth is prompting airlines to modernize their fleets with advanced avionics systems, which necessitate efficient data loading solutions. The avionics data-loaders market is poised to benefit from this expansion, as airlines require reliable systems to manage the data associated with new aircraft technologies. With projections indicating that the number of commercial aircraft in China could reach over 7,000 by 2035, the demand for avionics data-loaders is expected to grow significantly, potentially leading to a market growth rate of around 5% annually.

Emergence of Smart Aircraft Technologies

The advent of smart aircraft technologies is reshaping the aviation landscape in China, leading to a growing need for sophisticated avionics data management solutions. Smart aircraft, equipped with advanced sensors and connectivity features, generate vast amounts of data that require efficient processing and loading. This trend is likely to drive the avionics data-loaders market, as operators seek solutions that can handle the complexities of data management in real-time. The integration of artificial intelligence and machine learning in avionics systems further emphasizes the need for robust data loaders, suggesting a potential market expansion of approximately 7% over the next few years.

Increased Focus on Safety and Compliance

Safety and regulatory compliance remain paramount in the aviation industry, particularly in China, where stringent regulations govern aircraft operations. The need for compliance with international safety standards is driving airlines and manufacturers to invest in advanced avionics systems that require efficient data loading solutions. The avionics data-loaders market is likely to benefit from this focus on safety, as these loaders facilitate the timely and accurate updating of critical software and data. As the industry continues to prioritize safety, the demand for reliable avionics data-loaders is expected to rise, potentially leading to a market growth rate of around 6% annually.

Rising Demand for Advanced Avionics Systems

The avionics data-loaders market in China is experiencing a surge in demand due to the increasing adoption of advanced avionics systems across various aircraft types. As the aviation sector evolves, there is a notable shift towards integrating sophisticated technologies that enhance flight safety and operational efficiency. This trend is driven by both commercial and military aviation sectors, which are investing heavily in modern avionics solutions. According to recent estimates, the market for advanced avionics systems is projected to grow at a CAGR of approximately 8% over the next five years. Consequently, this growth is likely to propel the avionics data-loaders market, as these systems require efficient data management and loading solutions to function optimally.

Government Initiatives to Boost Aviation Sector

The Chinese government is actively promoting the aviation sector through various initiatives aimed at enhancing infrastructure and technological capabilities. These initiatives include substantial investments in airport expansions and the development of new aviation technologies. The government's commitment to increasing air traffic and improving connectivity is expected to drive the demand for modern avionics systems, which in turn will positively impact the avionics data-loaders market. With the aviation industry projected to contribute over $1 trillion to the national economy by 2030, the need for efficient data management solutions becomes increasingly critical, thereby fostering growth in the avionics data-loaders market.