Technological Innovations

Technological innovations play a pivotal role in shaping the Rough Terrain Crane Market. The introduction of advanced features such as telematics, automated controls, and enhanced safety systems has significantly improved the functionality and efficiency of rough terrain cranes. These innovations not only increase productivity but also reduce operational costs, making them more appealing to construction and industrial companies. The market is witnessing a trend towards the adoption of electric and hybrid cranes, which align with sustainability goals. As companies seek to modernize their fleets, the demand for technologically advanced rough terrain cranes is expected to rise, further propelling market growth.

Rising Demand in Mining Operations

Mining operations are a critical driver for the Rough Terrain Crane Market. The need for efficient material handling and equipment transportation in remote and rugged mining sites has led to an increased adoption of rough terrain cranes. These cranes are designed to operate in challenging terrains, making them ideal for mining applications. The mining sector is projected to grow, with an expected increase in mineral extraction activities. This growth is likely to create a substantial demand for rough terrain cranes, as they facilitate the movement of heavy equipment and materials. Furthermore, the integration of advanced technologies in these cranes enhances their operational efficiency, thereby attracting more investments in the mining sector.

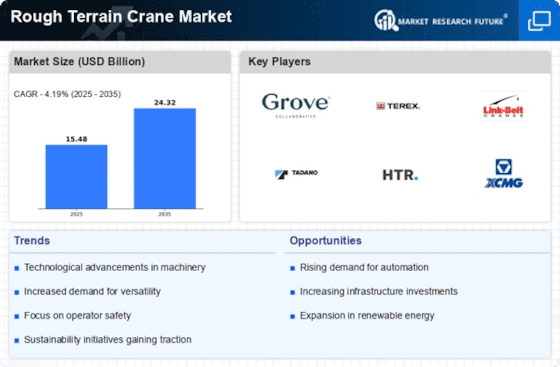

Increased Infrastructure Development

The Rough Terrain Crane Market is experiencing a surge due to the rising demand for infrastructure development. Governments and private sectors are investing heavily in construction projects, including roads, bridges, and commercial buildings. This trend is expected to continue, with the construction sector projected to grow at a compound annual growth rate of approximately 5% over the next few years. As a result, the need for versatile lifting equipment, such as rough terrain cranes, is likely to increase. These cranes are particularly suited for challenging environments, making them indispensable for construction sites that require mobility and adaptability. The expansion of infrastructure not only boosts the demand for rough terrain cranes but also enhances their technological advancements, further driving the market forward.

Expansion of Renewable Energy Projects

The Rough Terrain Crane Market is benefiting from the expansion of renewable energy projects, particularly in wind and solar energy sectors. The construction and installation of wind turbines and solar panels require specialized lifting equipment capable of operating in diverse terrains. Rough terrain cranes are increasingly being utilized for these applications due to their versatility and ability to navigate challenging landscapes. As countries commit to reducing carbon emissions and investing in renewable energy, the demand for rough terrain cranes is likely to grow. This trend not only supports the market but also encourages manufacturers to innovate and develop cranes that meet the specific needs of the renewable energy sector.

Growth in Logistics and Transportation

The logistics and transportation sector is a significant driver for the Rough Terrain Crane Market. As e-commerce continues to expand, the need for efficient material handling and transportation solutions has become paramount. Rough terrain cranes are essential for loading and unloading heavy goods in various environments, including construction sites and warehouses. The logistics industry is projected to grow, with an increasing focus on optimizing supply chains and improving operational efficiency. This growth is likely to lead to a higher demand for rough terrain cranes, as they provide the necessary flexibility and capability to handle diverse lifting tasks in challenging conditions.