Top Industry Leaders in the Rough Terrain Crane

Rough terrain cranes, with their brawny muscles and go-anywhere attitude, stand tall as workhorses of the construction world. These versatile giants tackle challenging terrains and tight spaces, lifting heavy loads where the smooth asphalt ends. But beneath the roar of their engines lies a competitive jungle where established titans clash with nimble innovators, all vying for a bigger share of the lifting pie. To navigate this dynamic landscape, understanding the strategies, market drivers, and recent developments is crucial.

Rough terrain cranes, with their brawny muscles and go-anywhere attitude, stand tall as workhorses of the construction world. These versatile giants tackle challenging terrains and tight spaces, lifting heavy loads where the smooth asphalt ends. But beneath the roar of their engines lies a competitive jungle where established titans clash with nimble innovators, all vying for a bigger share of the lifting pie. To navigate this dynamic landscape, understanding the strategies, market drivers, and recent developments is crucial.

Strategies for Hoisting Market Share:

-

Product Diversification: Offering a variety of crane capacities, boom lengths, and configurations caters to diverse project needs and widens market reach. Manitowoc, a dominant player, showcases this breadth with its extensive crane portfolio. -

Technological Innovation: Advanced features like load-moment limitation systems, telematics, and remote control are revolutionizing safety and efficiency. Demag, known for its cutting-edge technology, integrates AI-powered crane control systems for enhanced precision. -

Sustainable Focus: Reducing fuel consumption and emissions through hybrid engines and alternative power sources is becoming a key differentiator. Liebherr prioritizes eco-friendly technologies like bio-based fuels and energy-efficient drivetrains. -

Regional Expansion: Emerging markets in Asia and Africa present significant growth potential. XCMG actively establishes manufacturing and distribution networks in these regions. -

Strategic Partnerships and Acquisitions: Collaborations with technology providers, material suppliers, or niche players with specialized expertise can accelerate innovation and market access. Terex Corp.'s partnership with Genie for material handling equipment expands their reach into new segments.

Factors Weighing the Market's Balance:

-

Performance and Reliability: Robustness, lifting capacity, and maneuverability in rugged terrains are paramount. Grove cranes, renowned for their durability and performance, consistently secure major infrastructure projects. -

Cost-Effectiveness: Balancing initial investment with operational costs and profitability is crucial. Tadano focuses on affordable cranes without compromising on quality, making them popular in budget-conscious markets. -

After-Sales Service and Parts Availability: Prompt and reliable support, readily available spare parts, and efficient maintenance solutions significantly influence customer loyalty. Kato Works prioritizes a global service network and readily available parts to ensure operational uptime. -

Regulatory Compliance and Safety Standards: Meeting stringent safety regulations and emission standards is essential for market access. Zoomlion emphasizes compliance with regional regulations and invests heavily in safety training programs. -

Infrastructure Development and Construction Trends: Increased investments in infrastructure and construction projects directly boost demand for rough terrain cranes. Sany Heavy Industry leverages its strong presence in China's booming construction sector.

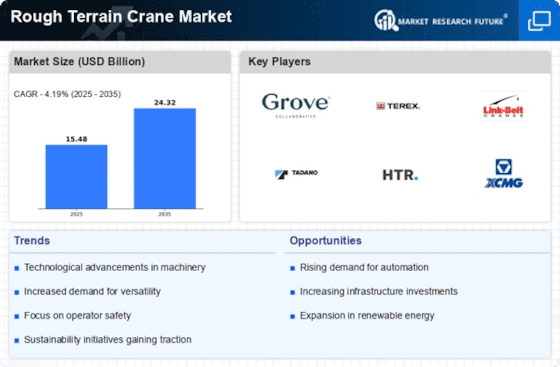

Key Companies in the rough terrain crane market include

Liebherr Group (Switzerland)

The Manitowoc Company, Inc. (U.S.)

Terex Corporation (U.S.)

Tadano Ltd. (Japan)

Xuzhou Construction Machinery Group Co., Ltd. (China)

KATO WORKS CO., LTD (Japan)

TIL Limited (India.)

ENTREC Corporation (Canada)

Manitex International Inc. (U.S.)

SANY GROUP (China)

Broderson Manufacturing Corp. (U.S.)

Maxim Crane Works, L.P. (U.S.)

Recent Developments:

-

August 2023: Liebherr unveils the new LTM 1130-5.1, boasting a 130-tonne capacity and improved maneuverability for challenging jobsites. -

September 2023: Tadano launches the GR-1400XL, its largest rough terrain crane yet, with a 140-tonne capacity for heavy lifting applications. -

October 2023: Manitowoc introduces the Grove GHC 75, its first electric rough terrain crane, targeting emission-conscious construction projects. -

November 2023: The Bauma 2023 trade fair showcases numerous advancements in rough terrain crane technology, including hybrid models and telematics systems.