Safety Improvements in Shipbuilding

Safety is a paramount concern in the shipbuilding sector, and the Robotics In Shipbuilding Market is addressing this issue effectively. The deployment of robotic systems reduces the risk of workplace accidents by taking over hazardous tasks, such as working in confined spaces or handling heavy materials. This shift not only protects workers but also enhances overall operational safety. Data suggests that shipyards utilizing robotics have reported a decrease in workplace injuries by up to 40%. As safety regulations become more stringent, the integration of robotics is likely to become a standard practice, further driving the market as companies prioritize the well-being of their workforce.

Enhanced Efficiency and Productivity

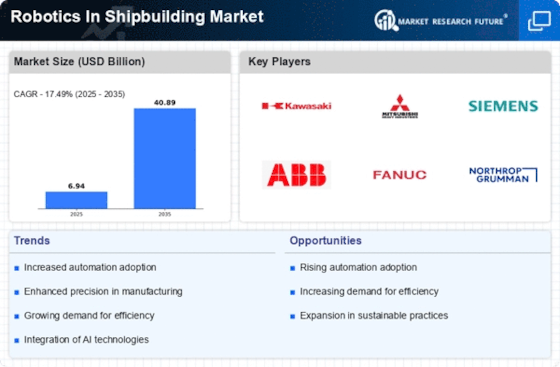

The Robotics In Shipbuilding Market is experiencing a notable shift towards enhanced efficiency and productivity through automation. The integration of robotics allows shipbuilders to streamline operations, reduce manual labor, and minimize human error. This transition is evidenced by a reported increase in production rates, with some shipyards achieving up to 30% faster turnaround times. As the demand for larger and more complex vessels rises, the need for efficient manufacturing processes becomes paramount. Robotics not only accelerates production but also improves precision in tasks such as welding and assembly. Consequently, shipbuilders are increasingly investing in robotic technologies to maintain competitiveness and meet the growing market demands.

Cost Reduction and Resource Optimization

Cost reduction remains a critical driver in the Robotics In Shipbuilding Market. The implementation of robotic systems can lead to significant savings in labor costs and material waste. By automating repetitive tasks, shipyards can allocate human resources to more skilled positions, thereby optimizing workforce utilization. Reports indicate that companies adopting robotics have seen a reduction in operational costs by approximately 20-25%. Furthermore, robotics enhances resource management by minimizing errors and ensuring consistent quality, which reduces the likelihood of costly rework. As shipbuilders strive to improve their bottom line, the adoption of robotics is increasingly viewed as a strategic investment.

Technological Advancements and Innovation

Technological advancements play a pivotal role in shaping the Robotics In Shipbuilding Market. Continuous innovation in robotics technology, including artificial intelligence and machine learning, is enhancing the capabilities of robotic systems. These advancements enable robots to perform complex tasks with greater autonomy and adaptability. The market is witnessing the emergence of collaborative robots, or cobots, which work alongside human operators, thereby increasing flexibility in production lines. As shipbuilders seek to leverage cutting-edge technologies to improve efficiency and reduce costs, the demand for advanced robotic solutions is expected to rise. This trend indicates a promising future for the robotics sector within shipbuilding.

Growing Demand for Customization and Flexibility

The growing demand for customization in shipbuilding is significantly influencing the Robotics In Shipbuilding Market. As clients increasingly seek tailored vessels, shipbuilders must adapt their production processes to accommodate unique specifications. Robotics offers the flexibility needed to produce customized designs efficiently. With the ability to quickly reprogram and modify robotic systems, shipyards can respond to changing customer requirements without extensive downtime. This adaptability is crucial in a competitive market where differentiation is key. As the trend towards bespoke shipbuilding continues, the integration of robotics will likely become essential for shipbuilders aiming to meet diverse client needs.