Labor Shortages and Skills Gap

The automotive manufacturing landscape is currently grappling with significant labor shortages, particularly in skilled positions. This challenge is exacerbated by an aging workforce and a lack of interest among younger generations in pursuing careers in manufacturing. Consequently, the Robotic Welding for Automotive Manufacturing Market is positioned to benefit from this trend, as companies seek to automate processes to mitigate the impact of labor shortages. The implementation of robotic welding systems not only addresses the skills gap but also enhances productivity, allowing manufacturers to maintain output levels despite workforce constraints. It is estimated that the market for robotic welding solutions could expand by over 20% in response to these labor dynamics, highlighting the critical role of automation in modern manufacturing.

Rising Focus on Cost Efficiency

Cost efficiency remains a paramount concern for automotive manufacturers, particularly in an increasingly competitive market. The Robotic Welding for Automotive Manufacturing Market is instrumental in driving down production costs through enhanced operational efficiencies. Robotic welding systems reduce material waste and minimize rework, which can lead to substantial savings. Recent analyses indicate that companies adopting robotic welding technologies can achieve cost reductions of approximately 15% to 25% in their welding operations. As manufacturers continue to seek ways to optimize their processes and improve profit margins, the demand for robotic welding solutions is likely to surge, reinforcing the market's growth potential.

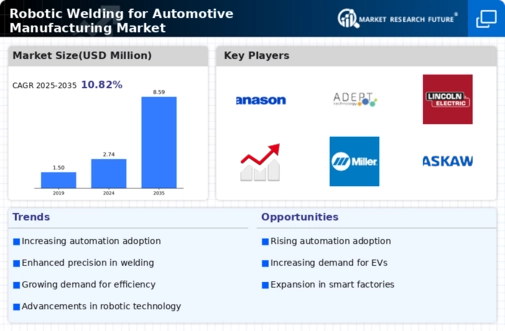

Technological Advancements in Robotics

The rapid evolution of robotics technology is significantly influencing the Robotic Welding for Automotive Manufacturing Market. Innovations such as artificial intelligence, machine learning, and advanced sensors are enhancing the capabilities of robotic welding systems, making them more adaptable and efficient. These advancements enable robots to perform complex welding tasks with greater precision and speed, thereby improving overall production timelines. Furthermore, the integration of smart technologies allows for real-time monitoring and predictive maintenance, reducing downtime and increasing operational reliability. As these technologies continue to advance, the market for robotic welding is expected to expand, driven by the need for more sophisticated manufacturing solutions.

Regulatory Compliance and Safety Standards

The automotive industry is subject to stringent regulatory compliance and safety standards, which are becoming increasingly rigorous. The Robotic Welding for Automotive Manufacturing Market is significantly impacted by these regulations, as manufacturers must ensure that their welding processes meet safety and quality benchmarks. Robotic welding systems are designed to enhance workplace safety by minimizing human exposure to hazardous environments and reducing the risk of accidents. Moreover, automated welding processes can help manufacturers achieve compliance with environmental regulations by reducing emissions and waste. As regulatory pressures continue to mount, the demand for robotic welding solutions is likely to grow, positioning the market for sustained expansion.

Increased Demand for Precision Manufacturing

The automotive sector is witnessing a pronounced shift towards precision manufacturing, which is crucial for enhancing vehicle quality and safety. This trend is largely driven by consumer expectations for higher performance and reliability in vehicles. Robotic Welding for Automotive Manufacturing Market plays a pivotal role in meeting these demands, as robotic systems offer unparalleled accuracy and repeatability in welding processes. According to recent data, the adoption of robotic welding solutions has led to a reduction in defect rates by up to 30%, thereby improving overall production efficiency. As manufacturers strive to maintain competitive advantages, the integration of robotic welding technologies becomes increasingly essential, suggesting a robust growth trajectory for the market.