Market Growth Projections

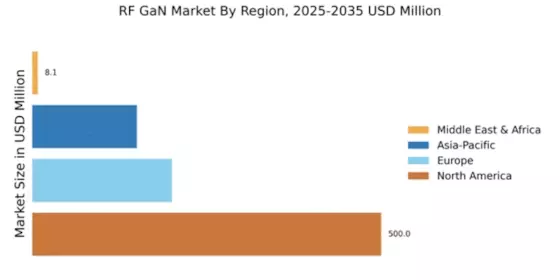

The Global RF GaN Market Industry is projected to experience substantial growth, with estimates indicating a market value of 16.7 USD Billion by 2035. This growth trajectory is underpinned by a compound annual growth rate (CAGR) of 30.97% from 2025 to 2035, reflecting the increasing adoption of GaN technology across various sectors. The market's expansion is driven by factors such as advancements in semiconductor technology, rising demand for high-efficiency power amplifiers, and the integration of GaN devices in emerging applications. These projections highlight the transformative potential of GaN technology in shaping the future of RF applications.

Advancements in Semiconductor Technology

The Global RF GaN Market Industry benefits from continuous advancements in semiconductor technology, which enhance the performance and reliability of GaN devices. Innovations in manufacturing processes, such as improved epitaxial growth techniques and substrate materials, lead to higher quality GaN wafers. These advancements not only reduce production costs but also improve device performance metrics, such as thermal management and power handling capabilities. As a result, the market is poised for substantial growth, with a projected CAGR of 30.97% from 2025 to 2035, indicating a robust trajectory fueled by technological progress.

Emerging Applications in Automotive Sector

The Global RF GaN Market Industry is witnessing emerging applications in the automotive sector, particularly with the rise of electric vehicles (EVs) and advanced driver-assistance systems (ADAS). GaN technology offers advantages such as reduced size and weight, which are crucial for automotive applications that prioritize efficiency and performance. As automotive manufacturers increasingly integrate RF components for communication and navigation systems, the demand for GaN devices is expected to rise. This trend indicates a potential for market expansion, aligning with the broader shift towards electrification and automation in the automotive industry.

Growth in Defense and Aerospace Applications

The Global RF GaN Market Industry is significantly influenced by the increasing adoption of GaN technology in defense and aerospace applications. The military's demand for advanced radar and communication systems necessitates high-performance components that can operate in extreme conditions. GaN's ability to provide high power density and efficiency makes it an ideal choice for these applications. As nations invest in modernizing their defense capabilities, the market is expected to expand, contributing to a projected market size of 16.7 USD Billion by 2035. This growth reflects the strategic importance of GaN technology in enhancing national security.

Rising Demand for High-Efficiency Power Amplifiers

The Global RF GaN Market Industry experiences a surge in demand for high-efficiency power amplifiers, particularly in telecommunications and aerospace sectors. As mobile networks evolve towards 5G, the need for robust power amplifiers that can handle higher frequencies and deliver superior performance becomes critical. This transition is projected to drive the market value to approximately 0.86 USD Billion in 2024. The efficiency of GaN technology, which allows for smaller and lighter components, aligns with the industry's push for compact and efficient designs, thereby enhancing overall system performance.

Increasing Investment in Telecommunications Infrastructure

The Global RF GaN Market Industry is bolstered by rising investments in telecommunications infrastructure, particularly as countries expand their 5G networks. The deployment of 5G technology necessitates the use of advanced RF components that can support higher data rates and lower latency. GaN technology, with its superior efficiency and performance characteristics, is increasingly being adopted in base stations and other critical infrastructure. This trend is expected to significantly contribute to the market's growth, with projections indicating a market value of 0.86 USD Billion in 2024, reflecting the urgency of upgrading existing networks to meet future demands.