Shift Towards Unmanned Systems

The Remote Weapon Stations Market is witnessing a pronounced shift towards unmanned systems, which is reshaping military operations. The increasing preference for unmanned aerial vehicles (UAVs) and ground systems is driving the demand for remote weapon stations that can be integrated with these platforms. This shift is largely motivated by the need for reducing personnel risk and enhancing operational efficiency. Data suggests that the market for unmanned systems is expected to grow significantly, with remote weapon stations playing a pivotal role in this transformation. As military forces seek to leverage the advantages of unmanned technologies, the Remote Weapon Stations Market is poised for substantial growth, reflecting the changing landscape of modern warfare.

Increased Focus on Force Protection

The Remote Weapon Stations Market is experiencing heightened attention towards force protection measures. Military organizations are increasingly recognizing the importance of safeguarding personnel and assets in combat scenarios. This focus is driving the adoption of remote weapon stations, which provide enhanced defensive capabilities without exposing operators to direct threats. Recent statistics indicate that investments in force protection technologies are on the rise, with remote weapon systems being a key component of these strategies. As nations prioritize the safety of their troops, the demand for advanced remote weapon stations is likely to grow, further solidifying their role in modern military operations. This trend underscores the critical importance of force protection in shaping the Remote Weapon Stations Market.

Emerging Markets and Defense Modernization

The Remote Weapon Stations Market is benefiting from the defense modernization efforts in emerging markets. Countries that are enhancing their military capabilities are increasingly investing in advanced technologies, including remote weapon stations. This trend is particularly evident in regions where defense budgets are expanding due to economic growth and security concerns. Data indicates that several emerging economies are prioritizing the acquisition of modern military systems, which includes remote weapon technologies. As these nations seek to modernize their armed forces, the Remote Weapon Stations Market is likely to see increased demand, reflecting the broader trend of military modernization across various regions. This development presents significant opportunities for manufacturers and suppliers in the remote weapon stations sector.

Geopolitical Influences on Defense Spending

The Remote Weapon Stations Market is notably influenced by geopolitical tensions and defense spending patterns. Countries facing security threats are increasingly allocating budgets towards advanced military technologies, including remote weapon stations. Recent data indicates that defense budgets in several regions have seen an uptick, with a focus on enhancing military capabilities. For example, nations in conflict-prone areas are prioritizing investments in unmanned systems and remote weapon technologies to bolster their defense strategies. This trend suggests that as geopolitical dynamics evolve, the demand for remote weapon stations will likely increase, further propelling the market forward. The interplay between international relations and defense procurement strategies is a critical driver for the Remote Weapon Stations Market.

Technological Advancements in Remote Weapon Stations

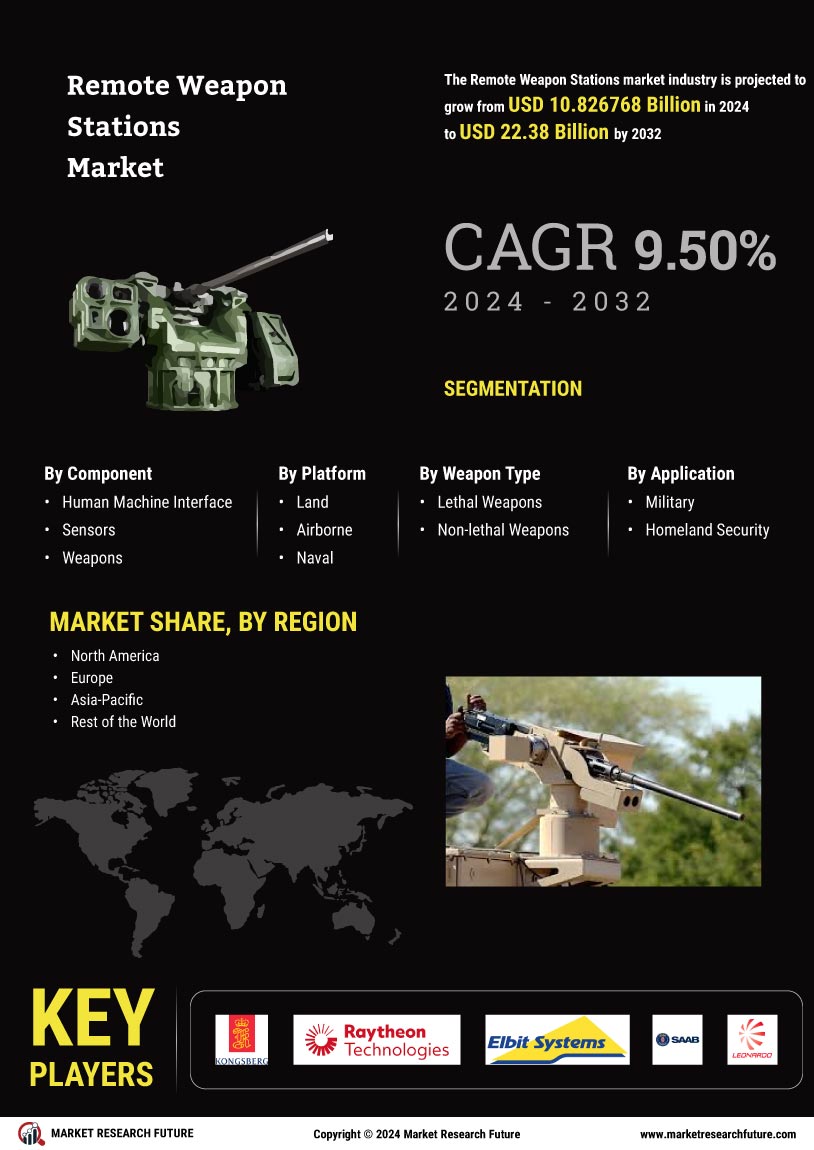

The Remote Weapon Stations Market is experiencing a surge in technological advancements, which is driving its growth. Innovations in sensor technology, artificial intelligence, and automation are enhancing the capabilities of remote weapon systems. For instance, the integration of advanced targeting systems and real-time data analytics is improving accuracy and operational efficiency. According to recent data, the market for remote weapon stations is projected to grow at a compound annual growth rate of approximately 7% over the next five years. This growth is largely attributed to the increasing demand for precision strike capabilities and the need for enhanced situational awareness in military operations. As nations invest in modernizing their defense systems, the Remote Weapon Stations Market is likely to benefit significantly from these technological advancements.

Leave a Comment