Rising Geopolitical Tensions

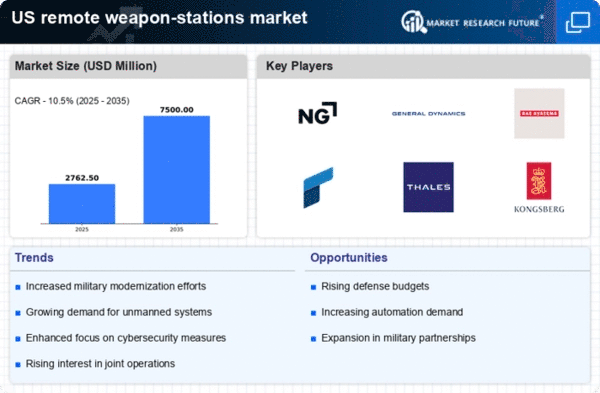

Rising geopolitical tensions in various regions are significantly impacting the remote weapon-stations market. The US has been increasingly involved in global security issues, necessitating the enhancement of its military capabilities. As nations invest in advanced weaponry to counter perceived threats, the US military is likely to respond by upgrading its own systems. This environment creates a favorable market for remote weapon-stations, as they provide a tactical advantage in conflict scenarios. The US defense budget reflects this urgency, with allocations for modernization programs expected to reach $50 billion by 2026, further driving the demand for advanced weapon systems.

Integration of Unmanned Systems

The integration of unmanned systems into military operations is a critical driver for the remote weapon-stations market. Unmanned aerial vehicles (UAVs) and ground vehicles are increasingly being equipped with remote weapon stations, allowing for real-time targeting and engagement without exposing personnel to danger. The US military's focus on unmanned systems is evident, with a projected growth rate of 15% in the UAV sector over the next five years. This integration not only enhances operational capabilities but also aligns with the military's strategy to modernize its forces. As unmanned systems become more prevalent, the demand for remote weapon-stations is expected to rise correspondingly.

Focus on Modular and Scalable Solutions

The remote weapon-stations market is witnessing a shift towards modular and scalable solutions that can be adapted to various platforms and missions. This flexibility is crucial for military operations, allowing forces to customize their weapon systems based on specific operational requirements. The US military's emphasis on interoperability among different branches of the armed forces is likely to drive the adoption of modular remote weapon-stations. As of 2025, approximately 30% of new military contracts are expected to focus on modular systems, indicating a significant trend towards adaptable solutions in the defense sector. This shift may enhance the overall effectiveness of military operations.

Increased Focus on Cybersecurity Measures

As the remote weapon-stations market evolves, the importance of cybersecurity measures becomes increasingly apparent. With the integration of advanced technologies, the potential for cyber threats poses a significant risk to military operations. The US military is prioritizing cybersecurity to protect its remote weapon systems from potential breaches. In 2025, the Department of Defense allocated $10 billion specifically for cybersecurity initiatives, reflecting the growing recognition of this issue. This focus on cybersecurity is likely to drive innovation within the remote weapon-stations market, as manufacturers develop systems that are resilient against cyber threats, ensuring operational integrity and reliability.

Growing Demand for Precision Strike Capabilities

The remote weapon-stations market is experiencing a notable increase in demand for precision strike capabilities. This trend is driven by the need for enhanced accuracy in military operations, which minimizes collateral damage and maximizes operational effectiveness. The US military has been investing heavily in technologies that allow for remote engagement of targets, thereby reducing the risk to personnel. In 2025, the US defense budget allocated approximately $800 billion, with a significant portion directed towards advanced weapon systems. This investment is likely to bolster the remote weapon-stations market, as military forces seek to integrate these systems into their operational frameworks to achieve strategic advantages.