Market Share

Remote Patient Monitoring Market Share Analysis

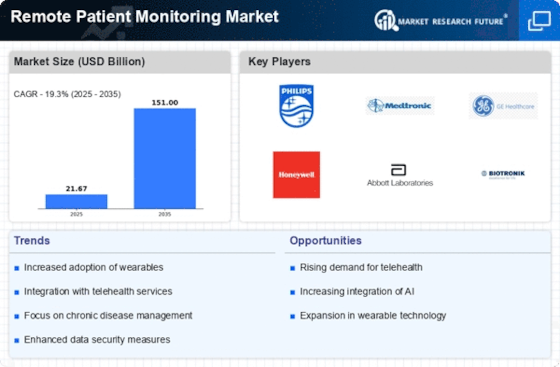

In rapidly expanding RPM (Remote Patient Monitoring) landscape, companies strive to be among the leaders through their preferred market share positioning strategies that are based on innovative healthcare solutions provision. A pivotal strategy is related to advanced technology Companies allocate considerably their funds for development of RDM, in order to upgrade capabilities of RPM devices, using innovative sensors, connectability and data analytics. Through offering sophisticated remote monitoring services that enable caregivers to trace down patients’ vital signs and health metrics in real-time using various devices, companies strive to occupy a niche in the RPM market, which attracts healthcare providers and patients who fancy easy and effective remote healthcare management.

Individualization and versatility are key factors in the remote patient monitoring market – a strategically positioned one. Acknowledging that various needs may exist among patients and healthcare providers, manufacturers create RPM systems which are customized to the particular medical conditions and data uploading needs of their customers. They can provide solutions tailored to dialysis house calls, after-surgical patient recovery, or simply generalizing well-being. The fact of RPM system adjustments for different patients groups and health care location setting is revealing the institutions as flexible to the special needs of the clients, adding up to the market share increase.

Strategic alliances and collaborations not only determine market share positioning in the Remote Patient Monitoring Market but also bring about significant impact on the industry as a whole. Companies choose a strategy of partnership to collaborate with hospitals, telemedicine providers and tech firms to provide the most comprehensive RPM solution possible. In the agreements, there will be several types of collaborations including joint research and development initiatives, integration with electronic health records (EHR) or co- marketing deals. Private healthcare providers through their strategic partners can extend their expertise and reach to their consumers, who can be offered complete RPM solutions that coincide with further health initiatives, and as a result, they will strengthen their market position and obtain the biggest stake of market share.

The collection of data and use of artificial intelligence are integral features of the market share positioning strategies that are used in the Remote Patient Monitoring Market. Companies concentrate on developing RPM systems which bigger data on top of advanced analytics and AI systems. This is in order to obtain meaningful insights. Through predictive features and advising individual health, companies position their RPM solutions as forward-looking tools that go beyond monitoring and with the vision of improving the quality of care while controlling healthcare costs. This focus on data analytics helps to nurture leading position by customers having reliable advices to guide them in the right direction of decision making.

Leave a Comment