Rising Demand for Telehealth Services

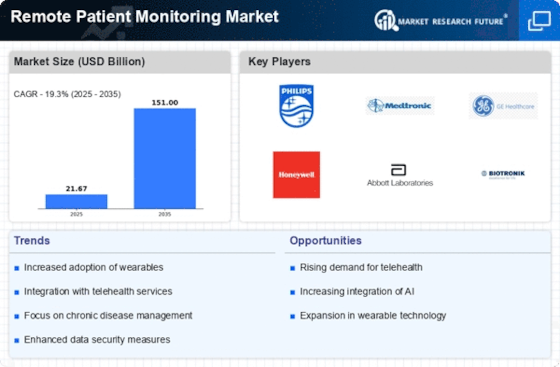

The Remote Patient Monitoring Market experiences a notable surge in demand for telehealth services. This trend is driven by the increasing need for accessible healthcare solutions, particularly for patients with chronic conditions. As healthcare providers seek to enhance patient engagement and improve outcomes, telehealth services have become integral. According to recent data, the telehealth market is projected to reach substantial figures, indicating a robust growth trajectory. This demand is further fueled by the convenience and flexibility that remote monitoring offers, allowing patients to receive care from the comfort of their homes. Consequently, the Remote Patient Monitoring Market is poised to benefit significantly from this rising trend, as healthcare systems adapt to meet the evolving needs of patients.

Growing Emphasis on Preventive Healthcare

The Remote Patient Monitoring Market is benefiting from a growing emphasis on preventive healthcare. As healthcare systems shift from reactive to proactive approaches, the focus on early detection and management of health issues becomes paramount. Remote monitoring technologies facilitate continuous health tracking, allowing for timely interventions that can prevent complications. This trend aligns with broader public health initiatives aimed at reducing healthcare costs and improving population health. Market data indicates that investments in preventive healthcare are increasing, which bodes well for the Remote Patient Monitoring Market. By enabling healthcare providers to monitor patients remotely, these technologies support the overarching goal of enhancing health outcomes and reducing the burden on healthcare systems.

Enhanced Patient Engagement and Empowerment

The Remote Patient Monitoring Market is increasingly characterized by enhanced patient engagement and empowerment. Patients are becoming more involved in their healthcare decisions, seeking tools that allow them to monitor their health actively. Remote monitoring solutions provide patients with real-time data about their health status, fostering a sense of ownership over their well-being. This shift towards patient-centered care is supported by evidence suggesting that engaged patients are more likely to adhere to treatment plans and achieve better health outcomes. As healthcare providers recognize the importance of patient engagement, the Remote Patient Monitoring Market is likely to expand, driven by the demand for technologies that empower patients in their health journeys.

Aging Population and Increased Chronic Conditions

The Remote Patient Monitoring Market is significantly influenced by the aging population and the rising prevalence of chronic conditions. As individuals age, they often experience multiple health issues that require continuous monitoring. Data suggests that the number of elderly individuals is expected to increase dramatically, leading to a higher demand for healthcare services. This demographic shift necessitates innovative solutions, such as remote patient monitoring, to manage health effectively. The Remote Patient Monitoring Market is likely to expand as healthcare providers implement these technologies to cater to the needs of an aging population, ensuring timely interventions and improved quality of life for patients.

Integration of Artificial Intelligence and Machine Learning

The Remote Patient Monitoring Market is witnessing a transformative phase with the integration of artificial intelligence (AI) and machine learning (ML) technologies. These advancements enable healthcare providers to analyze vast amounts of patient data, leading to more accurate diagnoses and personalized treatment plans. AI-driven algorithms can identify patterns and predict potential health issues, enhancing proactive care. The market data indicates that investments in AI and ML within healthcare are on the rise, suggesting a strong future for these technologies in remote monitoring. As healthcare systems increasingly adopt these innovations, the Remote Patient Monitoring Market is expected to experience substantial growth, driven by improved patient outcomes and operational efficiencies.

Leave a Comment