Growing Applications in Agriculture

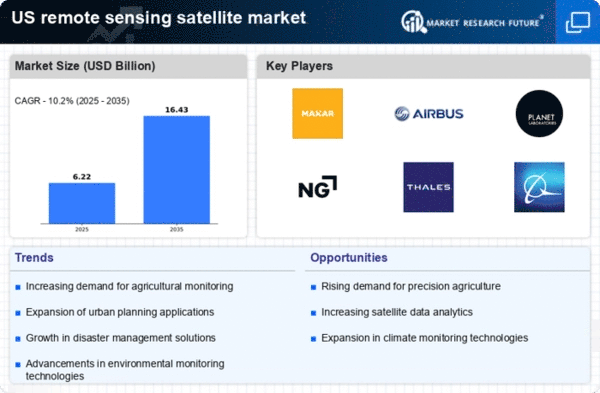

The remote sensing-satellite market is experiencing a surge in demand due to its growing applications in agriculture. Farmers and agribusinesses increasingly rely on satellite imagery to monitor crop health, assess soil conditions, and optimize resource allocation. This trend is supported by the need for precision agriculture, which can enhance yield by up to 20%. The integration of remote sensing data with machine learning algorithms allows for real-time analysis, enabling farmers to make informed decisions. As the agricultural sector in the US continues to embrace technology, the remote sensing-satellite market is projected to expand significantly, with an estimated growth rate of 15% annually over the next five years.

Environmental Monitoring and Management

Environmental concerns are driving the remote sensing-satellite market as stakeholders seek effective monitoring solutions. Satellites provide critical data for tracking deforestation, water quality, and climate change impacts. The US government has invested heavily in satellite programs aimed at environmental protection, with funding exceeding $1 billion annually. This investment supports initiatives that utilize satellite data for disaster response and resource management. As climate change awareness grows, the demand for accurate environmental monitoring through remote sensing is likely to increase, potentially leading to a market growth of 12% in the coming years.

National Security and Defense Applications

The remote sensing-satellite market is significantly influenced by national security and defense applications. The US government utilizes satellite technology for surveillance, reconnaissance, and intelligence gathering. With defense budgets exceeding $700 billion, a substantial portion is allocated to satellite capabilities. The need for enhanced situational awareness and threat detection drives innovation in satellite technology. As geopolitical tensions rise, the demand for advanced remote sensing solutions is likely to increase, suggesting a potential market growth of 8% over the next few years.

Urban Planning and Infrastructure Development

Urbanization in the US is propelling the remote sensing-satellite market, as cities require advanced tools for planning and infrastructure development. Satellite imagery aids in land use planning, traffic management, and urban heat island effect analysis. The market is expected to benefit from the increasing need for smart city initiatives, which leverage satellite data to enhance urban living conditions. With urban populations projected to rise by 10% by 2030, the demand for remote sensing solutions in urban planning is anticipated to grow, potentially reaching a market value of $5 billion by 2027.

Advancements in Data Analytics and AI Integration

The integration of advanced data analytics and artificial intelligence (AI) is transforming the remote sensing-satellite market. The ability to process vast amounts of satellite data quickly and accurately is becoming essential for various applications, including disaster management and resource allocation. Companies are investing in AI-driven platforms that can analyze satellite imagery to provide actionable insights. This trend is expected to enhance the efficiency of remote sensing applications, with the market projected to grow by 10% annually as organizations seek to leverage AI capabilities for improved decision-making.