- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

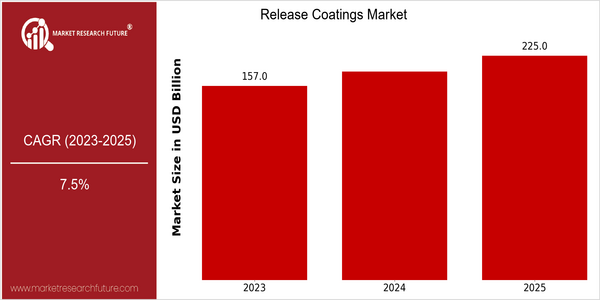

Release coatings Market Size Snapshot

| Year | Value |

|---|---|

| 2023 | USD 157.0 Billion |

| 2025 | USD 225.0 Billion |

| CAGR (2020-2025) | 7.5 % |

Note – Market size depicts the revenue generated over the financial year

The release coatings market is expected to grow significantly over the forecast period, with the current market size projected to reach USD 157.7 billion by 2023, and is expected to reach USD 225.0 billion by 2025. This growth is projected at a CAGR of 7.4 % from 2020 to 2025. The key factors driving the growth of this market are the rising demand for high-performance and cost-effective release coatings across various industries, such as packaging, automotive, and electronics. The development of eco-friendly and high-temperature resistant coatings is also expected to drive the market growth, as manufacturers are focusing on improving the performance of their products while maintaining the highest level of safety. The key players in the release coatings industry, such as Dow Chem. Co., BASF SE, and Momentive Performance Materials, are focusing on investing in research and development to expand their product offerings. The strategic collaborations and agreements are expected to further enhance the product offerings and market reach. The recent product launches focusing on bio-based release coatings are a clear indication of the shift towards sustainable solutions, in line with the changing consumer preferences and the growing emphasis on sustainable development. These factors will play a significant role in shaping the future of the market.

Regional Deep Dive

Release Coatings Market is experiencing dynamic growth in all regions, driven by the rising demand from industries such as packaging, automobile, and electronics. In North America, the market is characterized by a strong focus on innovation and sustainable development, with companies focusing on developing eco-friendly release coatings. In Europe, the regulatory environment is conducive to the use of advanced materials, and the demand for release coatings is increasing in the Asia-Pacific region due to rapid urbanization and industrialization. The Middle East and Africa are gradually becoming potential markets due to the development of the construction industry, and the expansion of the packaging industry in Latin America is driving the market.

North America

- In the United States the new EPA regulations limit the use of volatile organic compounds in paints. This has led to the development of low-VOC coatings.

- In order to develop such sustainable release coatings, companies like Dow and 3M are investing heavily in research and development.

- The increase in the e-commerce has increased the demand for a quick and easy packaging. This has pushed the demand for advanced release coatings in the packaging industry.

Europe

- The Green Deal of the European Union has pushed for the introduction of a more sustainable production, causing a surge in demand for biodegradable release linings.

- High-performance release coatings from BASF and Evonik are being developed for the automobile and aeronautics industries.

- The regulatory framework regarding the safety and environmental impact of chemicals forces manufacturers to adapt their product lines, thereby promoting competition.

Asia-Pacific

- China's rapid industrialization and urbanization are causing the demand for release coatings in the construction and packaging industries to increase.

- Mitsui and Shin-Etsu have been increasing their production in order to meet the growing demand of the region.

- The state policy to increase the industrial capacity creates a favorable environment for the release coatings market.

MEA

- The UAE Vision 2021 programme aims at sustainable development, which has led to the adoption of eco-friendly release coatings in many sectors.

- The local companies are beginning to work with international companies to improve their product range, which is driving innovation in the release coatings market.

- The growing construction and automobile industries in countries like Saudi Arabia are expected to drive the demand for special release coatings.

Latin America

- Brazil’s growing packaging industry is driving the release coatings market. With the expansion of the packaging industry, local manufacturers are constantly looking for new and improved solutions to increase product performance.

- In Argentina, the regulatory framework is encouraging the use of environmentally friendly coatings, which is forcing manufacturers to adapt their products.

- The growth of e-commerce and the development of the consumer goods market in the region are driving the demand for efficient packaging solutions, which is driving the growth of the release paper market.

Did You Know?

“The market for release linings is shifting from synthetic to natural and sustainable products. Eco-friendly linings may represent more than a third of the market by 2025, according to some forecasts.” — Market Research Future

Segmental Market Size

Release Coatings Market is currently growing steadily, driven by the rising demand for various industries such as automobile, aeronautics and consumer goods. This is primarily due to the need for increased production efficiency and the growing focus on sustainable production, which is driving the demand for eco-friendly and sustainable products. This is further encouraged by the emergence of regulations that require the use of low-VOC materials.

At the moment, the use of release coatings is at a stage of trial implementation, with Dow and BASF in particular bringing in new product developments. The most important application areas are the manufacture of composite materials in the automobile industry and the food packaging industry, which use release coatings to ensure easy release of the product and maintain hygiene. The trend towards sustainable production and the development of nanotechnology are driving growth, while digital printing and the automation of application processes are shaping the industry’s future.

Future Outlook

Release Coatings Market is estimated to have a CAGR of 7.5% from 2023 to 2025. Release coatings are used as a release agent in many industries, such as food, transportation, and consumer goods. Release coatings are also used as a release agent in many industries, such as food, transportation, and consumer goods. As manufacturers focus more on efficiency and sustainability, the adoption of advanced release coatings that can improve product performance while reducing the impact on the environment is expected to increase.

The market is also influenced by the development of biodegradable and silicone-free release liners. These innovations not only meet the legal requirements but also meet the increasing demand for eco-friendly products. In addition, the increasing automation of production processes is expected to increase the demand for high-performance release liners, as companies strive to optimize production efficiency and reduce waste. Furthermore, the integration of smart technology into the coating of the release liners will have a significant impact on the market.

Release coatings Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.