Advancements in Data Analytics

The Reinsurance Market is witnessing a transformative shift driven by advancements in data analytics. Insurers and reinsurers are leveraging sophisticated data analytics tools to enhance risk assessment and pricing strategies. The integration of big data and machine learning allows for more accurate predictions of risk exposure, which is crucial in a market characterized by volatility. Reports suggest that the use of predictive analytics can improve underwriting performance by up to 20%, thereby increasing profitability for reinsurers. Additionally, these technologies enable better claims management and fraud detection, further solidifying the role of reinsurers in the insurance ecosystem. As the industry continues to embrace these innovations, the reinsurance market is likely to expand, attracting new players and fostering competition among existing firms.

Increased Natural Catastrophes

The Reinsurance Market is currently experiencing heightened demand due to the increasing frequency and severity of natural catastrophes. Events such as hurricanes, floods, and wildfires have led to substantial losses for primary insurers, prompting them to seek reinsurance solutions to mitigate risk. According to recent data, the economic losses from natural disasters have surged, with estimates indicating that insured losses could reach upwards of 100 billion dollars annually. This trend compels insurers to transfer a portion of their risk to reinsurers, thereby bolstering the reinsurance market. Furthermore, reinsurers are adapting their models to account for climate change, which is likely to exacerbate these events. As a result, the reinsurance market is positioned to grow as insurers increasingly rely on reinsurance to stabilize their financial performance in the face of unpredictable natural disasters.

Regulatory Changes and Compliance

The Reinsurance Market is significantly influenced by evolving regulatory frameworks that govern insurance practices. Regulatory bodies are increasingly imposing stringent requirements on insurers, particularly concerning capital reserves and risk management practices. This regulatory landscape compels insurers to seek reinsurance as a means of compliance, thereby driving demand for reinsurance products. For instance, Solvency II regulations in certain regions necessitate that insurers maintain adequate capital buffers, which can be achieved through reinsurance arrangements. As a result, reinsurers are positioned as critical partners in helping insurers navigate these complex regulatory environments. The ongoing changes in regulations may also lead to the emergence of new reinsurance products tailored to meet compliance needs, further expanding the reinsurance market.

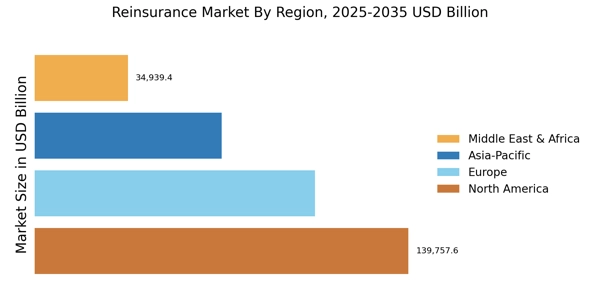

Emerging Markets and Economic Growth

The Reinsurance Market is poised for growth as emerging markets experience economic expansion and increased insurance penetration. Countries in Asia, Africa, and Latin America are witnessing a rise in disposable income, leading to greater demand for insurance products. This trend is expected to drive the need for reinsurance as local insurers seek to manage their risk exposure effectively. Data indicates that insurance penetration in emerging markets is projected to grow at a compound annual growth rate of 5 to 7% over the next decade. Consequently, reinsurers are likely to focus on these regions to capitalize on the burgeoning demand for reinsurance solutions. The expansion into emerging markets presents both opportunities and challenges, as reinsurers must navigate diverse regulatory environments and varying levels of market maturity.

Technological Disruption and Innovation

The Reinsurance Market is undergoing a phase of technological disruption, with innovations reshaping traditional business models. The rise of insurtech companies is challenging established reinsurers to adapt and innovate. These new entrants are leveraging technology to offer more efficient and customer-centric solutions, which could potentially alter the competitive landscape of the reinsurance market. For instance, blockchain technology is being explored for its potential to enhance transparency and streamline claims processing. Additionally, the adoption of artificial intelligence in underwriting processes is likely to improve accuracy and speed. As these technological advancements continue to evolve, they may compel traditional reinsurers to rethink their strategies and invest in new technologies to remain competitive. This dynamic environment suggests that the reinsurance market will continue to evolve, driven by the need for innovation and efficiency.