Growing Healthcare Infrastructure

The expansion of healthcare infrastructure in the GCC region is a significant driver for the refurbished medical-devices market. As governments invest heavily in healthcare facilities, there is a corresponding need for medical equipment. Refurbished devices offer a practical solution to meet this demand without straining budgets. The refurbished medical-devices market is likely to see increased activity as new hospitals and clinics open, particularly in underserved areas. This growth in infrastructure not only supports the availability of healthcare services but also creates opportunities for suppliers of refurbished medical devices to establish partnerships with emerging healthcare providers.

Increased Focus on Sustainability

Sustainability has emerged as a critical driver in the refurbished medical-devices market. With growing awareness of environmental issues, healthcare organizations in the GCC are seeking ways to reduce waste and promote eco-friendly practices. Refurbished devices contribute to this goal by extending the lifecycle of medical equipment and minimizing the environmental impact associated with manufacturing new devices. The refurbished medical-devices market is likely to benefit from this shift, as more institutions adopt sustainable procurement policies. This trend not only aligns with global sustainability goals but also enhances the reputation of healthcare providers committed to environmental stewardship.

Regulatory Framework Enhancements

The regulatory landscape surrounding medical devices in the GCC is evolving, which may positively impact the refurbished medical-devices market. Recent initiatives aimed at streamlining the approval process for refurbished equipment are likely to encourage more manufacturers and suppliers to enter the market. Enhanced regulations can lead to increased consumer confidence in refurbished devices, as they are perceived to meet stringent safety and quality standards. This regulatory support may facilitate market growth, as healthcare providers become more willing to incorporate refurbished devices into their operations, thereby expanding the refurbished medical-devices market.

Technological Integration and Innovation

The refurbished medical-devices market is being propelled by advancements in technology that enhance the quality and reliability of refurbished equipment. Innovations in refurbishment processes, such as improved testing and certification standards, ensure that these devices meet high performance benchmarks. As a result, healthcare providers in the GCC are increasingly confident in the efficacy of refurbished devices. The integration of advanced technologies, such as artificial intelligence and machine learning, into refurbished equipment further boosts their appeal. This trend indicates a shift in perception, where refurbished devices are seen as viable alternatives to new equipment, thereby expanding the refurbished medical-devices market.

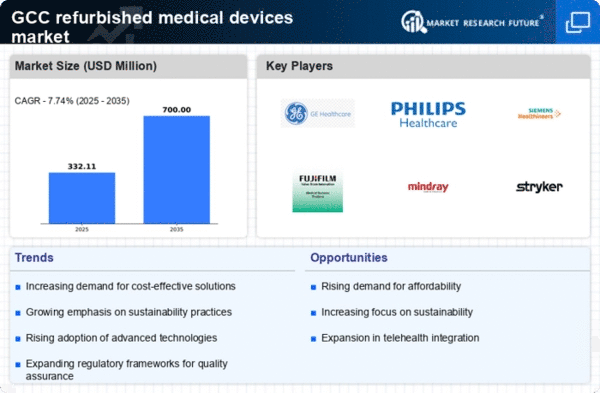

Rising Demand for Cost-Effective Solutions

The refurbished medical-devices market is experiencing a notable increase in demand for cost-effective healthcare solutions. As healthcare providers in the GCC region face budget constraints, the appeal of refurbished devices becomes more pronounced. These devices often provide similar functionality to new equipment at a fraction of the cost, making them an attractive option for hospitals and clinics. Recent data indicates that the market for refurbished medical devices in the GCC is projected to grow at a CAGR of approximately 10% over the next five years. This trend suggests that healthcare facilities are increasingly prioritizing financial sustainability while maintaining quality care, thereby driving the growth of the refurbished medical-devices market.